How To Setup Transaction Types

This document explains the concept of Transaction Type in Collect!. It will help you use existing transaction types

in the right way and create your own.

Transaction types are an integral part of Collect!, and are used for recording and organizing financial information.

The Financial Type field in the Transaction form determines how Collect! will process a transaction. Payments, Fees,

Interest, Adjustments, Legal are examples of these Financial Types.

For convenience and reporting, Collect! organizes Transaction Types into groups of 100, with the 100, 200, 300, 400, 500 and 600

codes actually reserved as titles for the group they represent. Each series roughly represents one of the Financial Types.

For instance, the 100 series is reserved for Payment types. However, it is the Financial Type setting that actually determines

how a transaction is processed.

Financial Type Setting Determines Transaction Type

Transaction types are used when printing client and debtor trust account reports. The reports provide a dated summary

of financial transactions, and then show a breakdown of the financial activities, usually organized by Transaction series,

such as 100's, 200's and so forth. Using these groups will help you with the organization of your own reports.

For example, Group 100 defines all basic transactions such as payment from a Debtor to the agency by check or cash,

payments from the Client to the agency and other details.

Several groups are predefined, including Original Principal and Interest, Legal Expenses, Interest and Other Expenses.

The Demonstration database in Collect! ships with many predefined transaction types. You can copy any of

these to the Masterdb database.

The Demonstration database in Collect! ships with many predefined transaction types. You can copy any of

these to the Masterdb database.

Viewing The List Of Transaction Types

The following list contains all the transaction types provided for you by Collect! You can modify these if you need to or add

your own, depending on your business needs.

Codes And Descriptions

100 PAYMENTS AND SYSTEM

101 Check Payment

102 Cash Payment

103 Payment Out of Court

104 Money Order Payment

105 Returned NSF Check

106 Payment of Agency NSF Fee

107 Check Payment Taken By Phone

108 Debtor Over Payment

109 Credit Card Payment

110 ACH Payment

111 Direct Payment to Client

120 Attorney Fee Payment

122 Court Cost Payment

150 Down Payment

151 Payment Plan Payment

160 Monthly Billing Amount

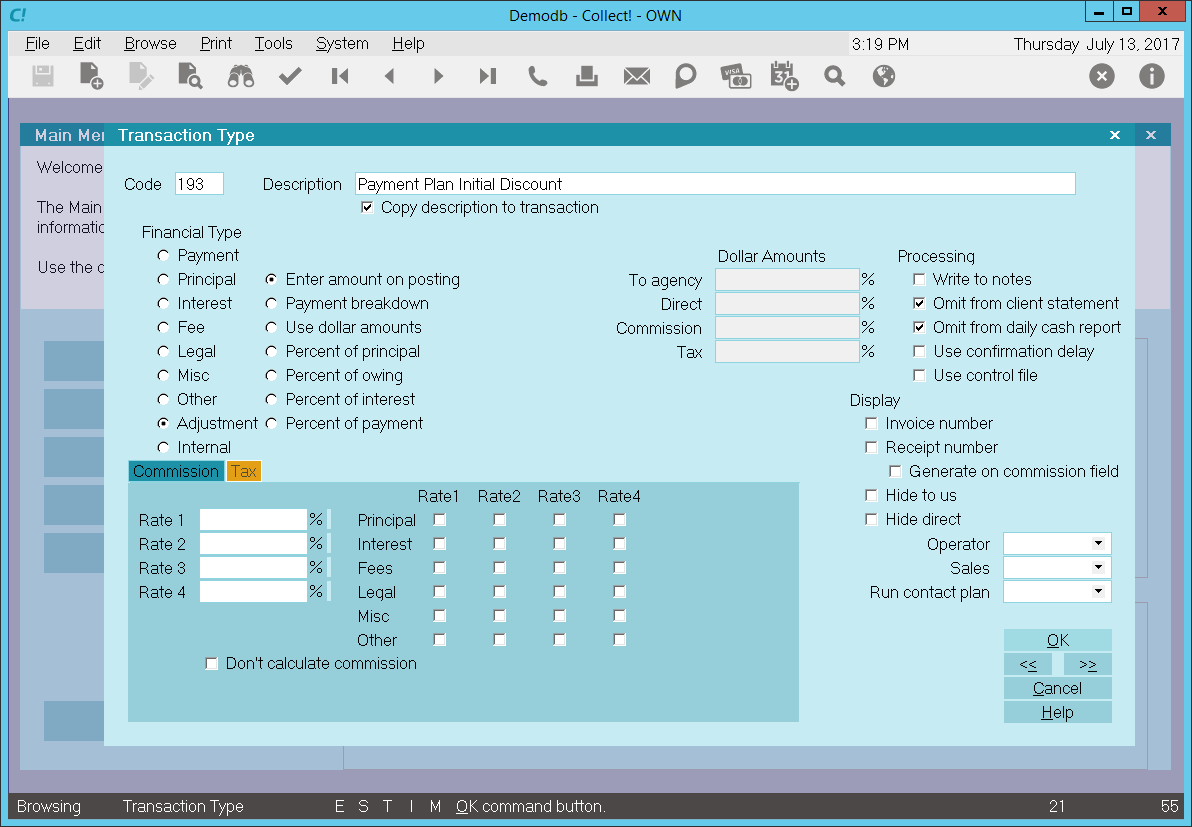

193 Payment Plan Initial Discount

194 Judgment Principal - don't modify

195 Judgment Interest - don't modify

196 Original Principal - don't modify

197 Original Interest - don't modify

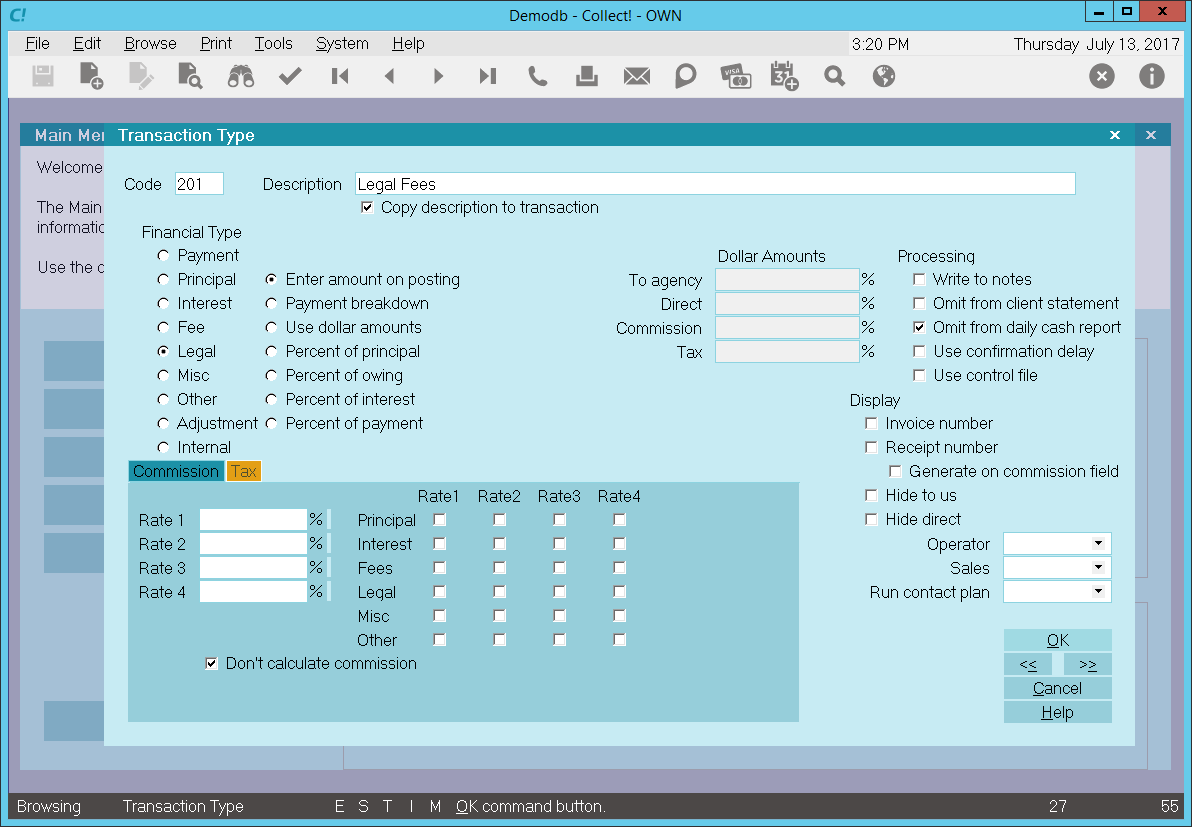

200 LEGAL FEES

201 Court Cost Charge

202 Attorney Fees Charge

294 Judgement Legal Costs - don't modify

300 FEES

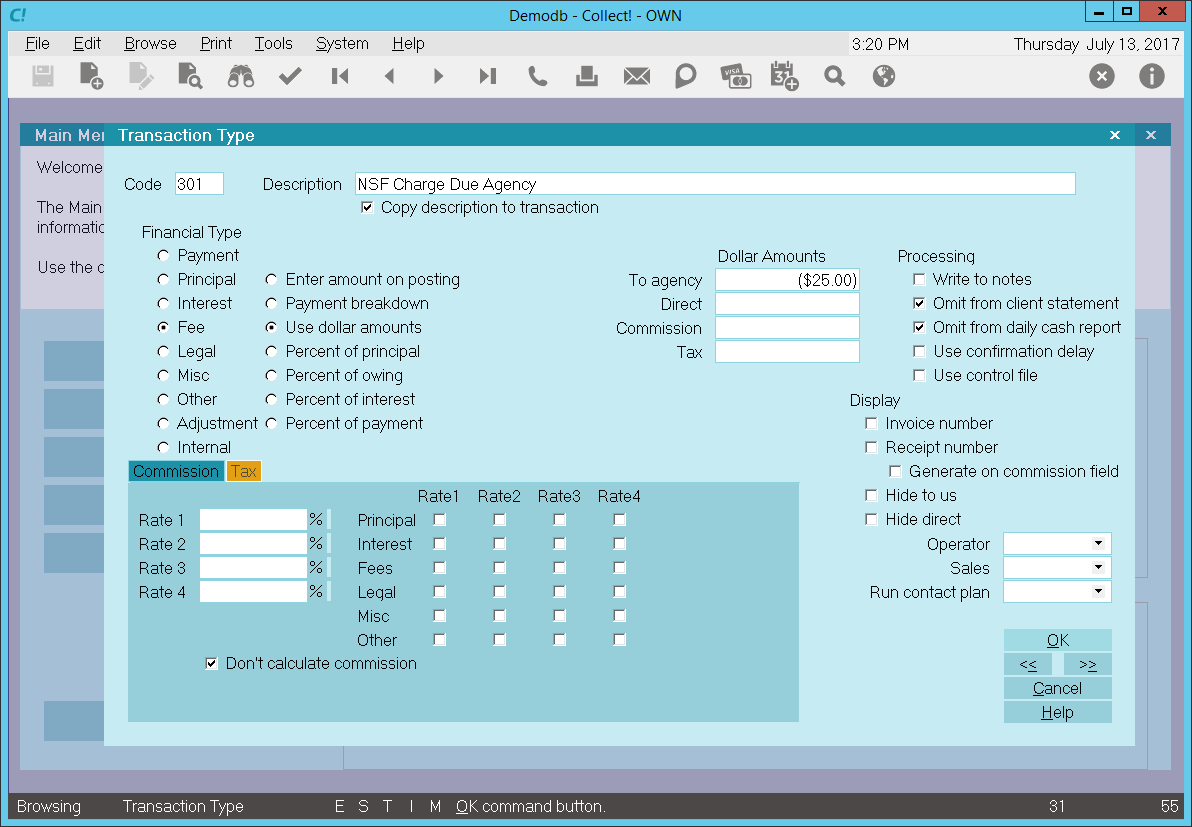

301 NSF Charge Due Agency

302 Closing Fee

303 Locate Fee

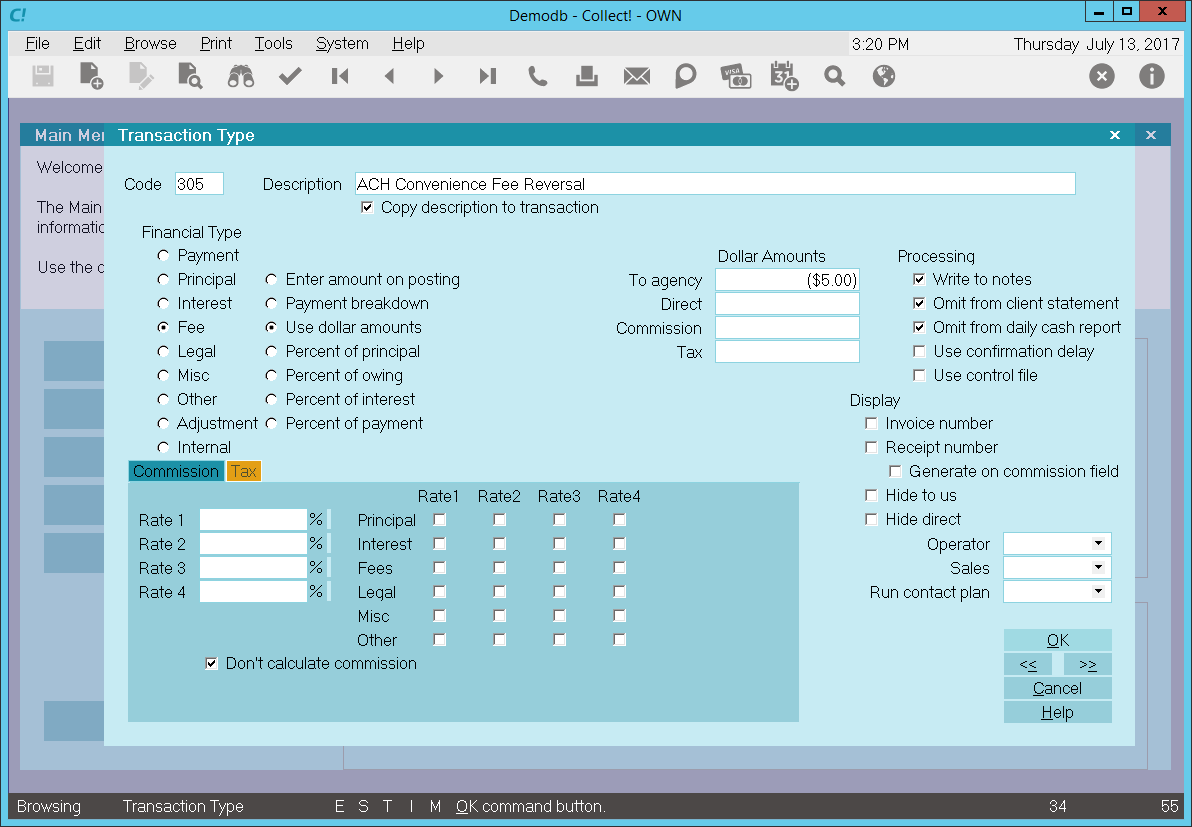

305 ACH Convenience Fee Reversal

307 ACH Convenience Fee

309 Credit Card Convenience Fee

310 Service Charge

320 Payment Plan Late Fee

340 Daily Storage Fee

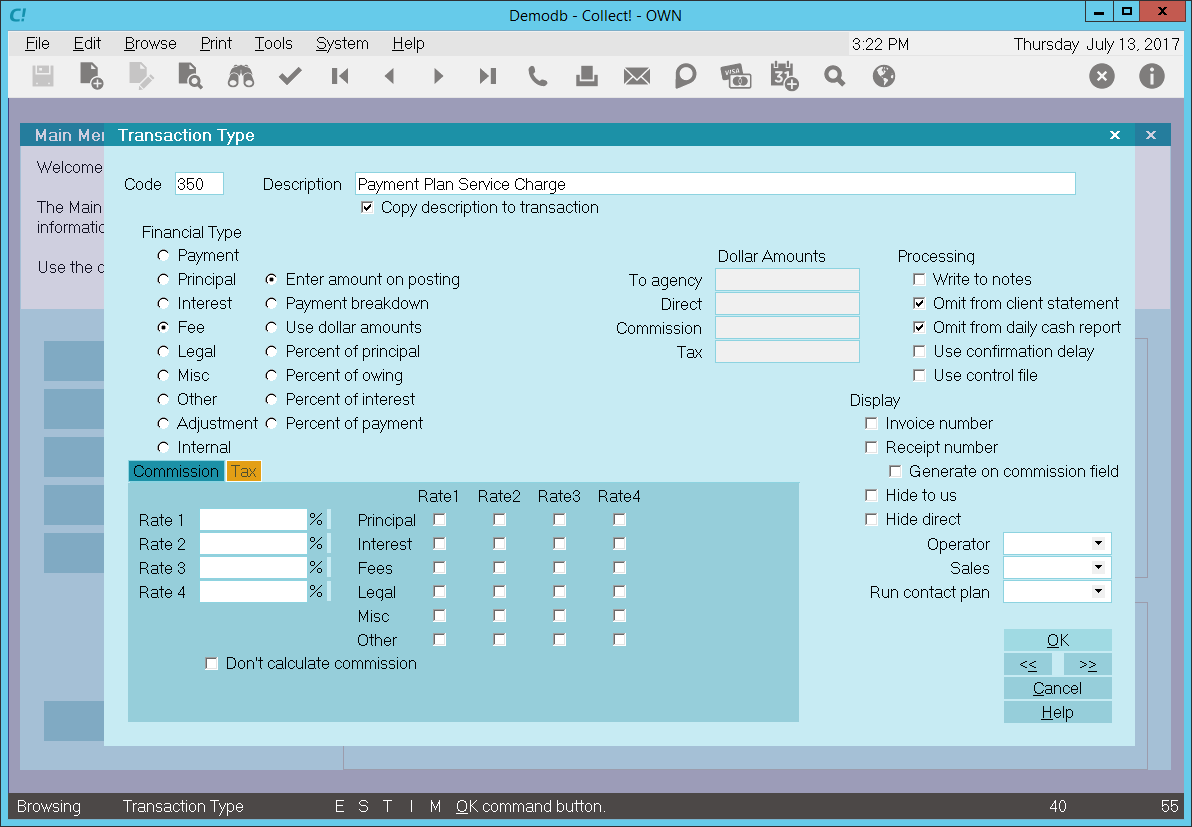

350 Payment Plan Service Charge

351 Late Fee - don't modify

394 Judgement Court Costs - don't modify

397 Client Fee - don't modify

398 Debtor Fee - don't modify

399 Collection Fee - don't modify

400 INTEREST

401 Interest Adjustment

402 Accrued Compound Interest

495 Additional Judgement Interest

499 Total Accrued Interest - don't modify

500 ADJUSTMENTS

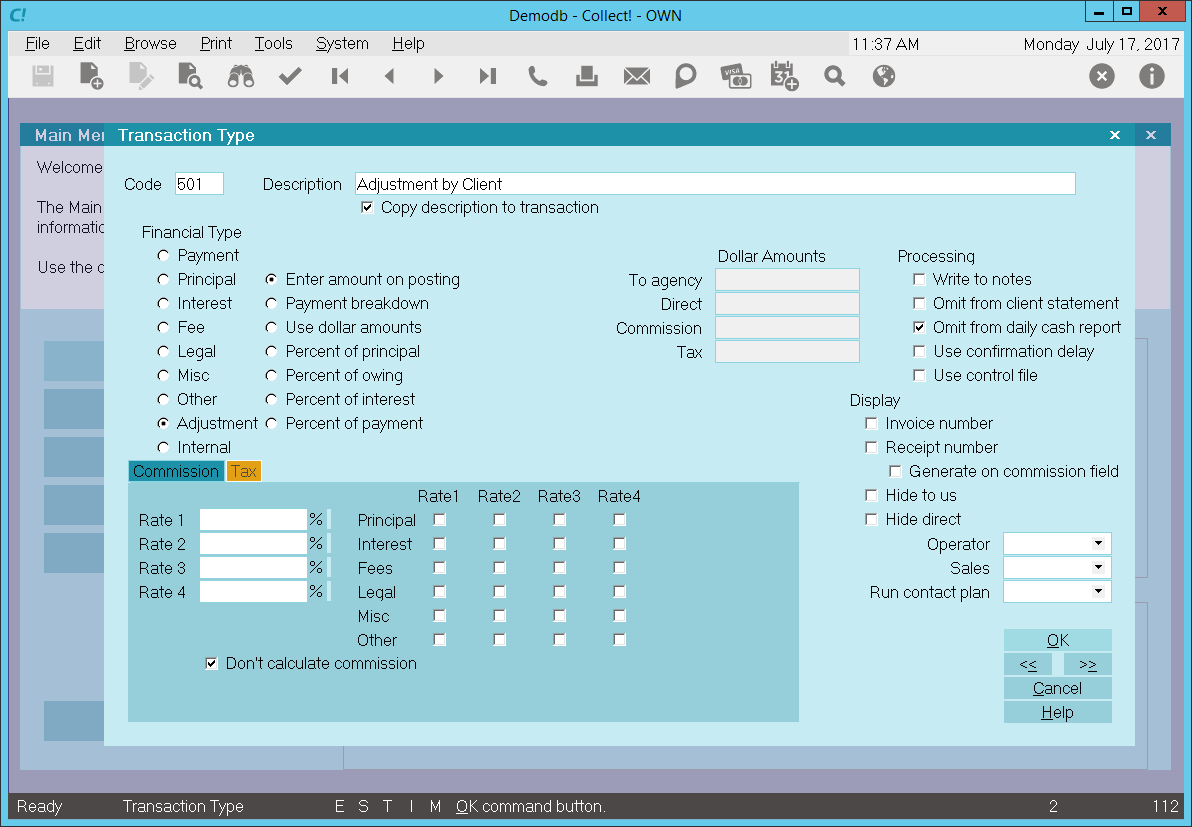

501 Adjustment by Client

502 Adjustment by Court Order

503 Adjust Judgement Principal

599 Adjustment through Upgrade - don't modify

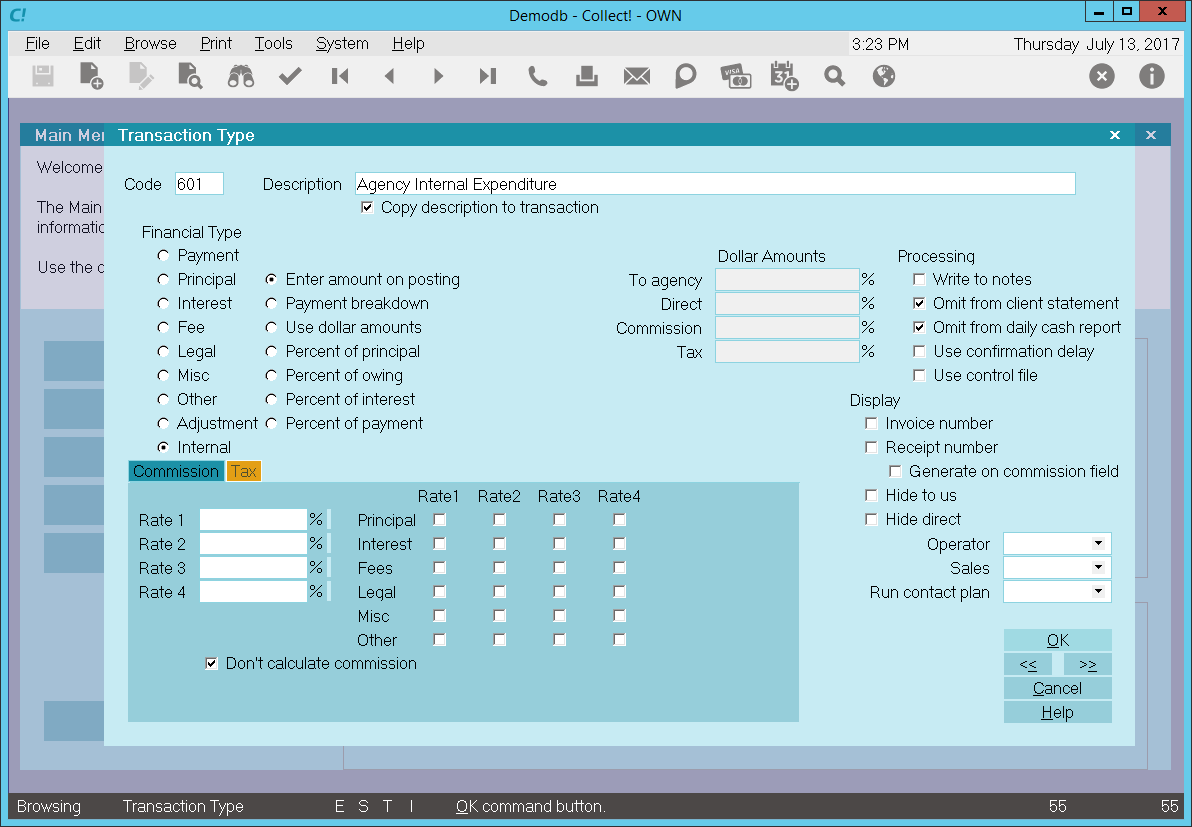

600 INTERNAL EXPENSES

601 Agency Internal Expenditure

Each one of these transaction types has its own settings, set in the Transaction Type form for that type.

To view the settings for these transaction types, pull down the System menu and choose Financial Settings,

Transaction Types. The complete list of transaction types available to you will be displayed. Click on your choice

to open the Transaction Type form and view the settings.

To view the settings for these transaction types, pull down the System menu and choose Financial Settings,

Transaction Types. The complete list of transaction types available to you will be displayed. Click on your choice

to open the Transaction Type form and view the settings.

You should leave code 100, 200, 300 and 400 etc. as titles for the group they represent. Then use codes

101, 201, 301, 401, 501, 601 as the starting points for the transaction types you want to list in the group. You can

You should leave code 100, 200, 300 and 400 etc. as titles for the group they represent. Then use codes

101, 201, 301, 401, 501, 601 as the starting points for the transaction types you want to list in the group. You can

also create your own groups and codes with up to 4 characters and then build reports that reference transactions with

these codes.

Please note that Collect! code internally and they should not be altered.

Please note that Collect! code internally and they should not be altered.

194 Judgment Principal

195 Judgment Interest

196 Original Principal

197 Original Interest

294 Judgement Legal Costs

394 Judgement Court Costs - don't modify

397 Client Fee

398 Debtor Fee

399 Collection Fee

499 Total Accrued Interest

599 Adjustment through Upgrade

If these codes do not appear in your Transaction Type list, then they will appear as numbers in your trust reports, rather than

with text titles. You should create these codes in your Transaction Type list if they are not there. These Transaction

Type codes are required, and should not be changed. Most of the others can safely be modified.

Print A List Of All Settings

To view all of the transaction types available in Collect!, pull down the System menu and choose Financial Settings,

Transaction Types. A list will display. You could pull down the Print menu and choose Quick Print from the list of choices.

When prompted, say "Yes" to details. This will give you a complete list of the transaction types and their settings.

Using The Predefined Transaction Types

Press F1 from the Transaction form and the Transaction Types form to get Help on the fields in these form. Using this information

and the list above, pick the transaction types that you need.

Examine the settings of these transaction types to be sure they will act as you expect them to. Most of the types can be

modified. However, you should be sure of what you are doing when you make changes to existing Transaction Type settings.

These settings have been chosen to perform in a certain way.

Creating Your Own Transaction Types

The easiest way to create a new transaction type is to copy an existing type, or heading, give it a new Code number, in the

same general group, and a new Description. Then modify the settings to suit your needs.

Each group heading has default settings that generally apply to the whole group. You can copy the heading as a

template for your new type and the basic settings will be set already.

Each group heading has default settings that generally apply to the whole group. You can copy the heading as a

template for your new type and the basic settings will be set already.

Copy A Transaction Type

1. Choose System, Financial Settings, Transaction Types to display the list of types in your system.

2. Use the up and down arrows to locate and highlight the type or heading that you wish to copy.

3. Make sure it is highlighted and press CTRL+C. You will be informed that you have copied data.

4. Press OK and then press CTRL+V. The list will now contain a duplicate copy of the transaction type or heading that you copied.

5. Click on one of the copies to open the Transaction Type form for you to modify.

6. Give your copy a new Code number and a new Description to begin to create your own transaction type.

Create A Transaction Type Group

To add group 700, for example, to the Transaction Type list:

1. Open the Transaction Type List.

2. Press F3 to create a new Transaction Type.

3. Enter 700 as the Code to identify the group.

4. Type in a general Description that applies to each transaction type in this new group.

The Description you use to label the group is used in trust account reports as the title of the Transaction group.

The Description you use to label the group is used in trust account reports as the title of the Transaction group.

5. Choose the default settings that will generally apply to transaction types in this group. These settings can be modified

for each individual transaction type that you create in the group.

6. Press F8 to save your work.

Now, when you view the list of transaction types, this new group will display.

Create A Transaction Type

As described above, you can copy an existing type or heading and modify it.

Or, you can press F3 when you are viewing the transaction type list or an individual transaction type. This will display a

new blank transaction type form for you to fill out. (Or press the NEW button on the toolbar or the NEW button at the

bottom of the transaction type list.)

Transaction Type Settings

Each Transaction Type has its own unique settings. These control report printing options, calculations, commission

rate, perhaps running a Contact Plan, assigning operators and sales persons to transactions.

There are over twenty settings on the Transaction Type form that you can choose from to setup a particular Transaction Type. The

ability to select a Contact Plan to run offers many more choices as well. (This means that once you know what your business needs

are, you can create uniquely customized transaction types to automate your transaction posting operations.)

Each section heading in the Transaction Type list has default settings that generally apply to any new transaction type

Each section heading in the Transaction Type list has default settings that generally apply to any new transaction type

that you create in that category. You can use these settings as a starting point when you create your

transaction types.

1. From the Transaction and the Transaction Types forms, press F1 for Help about the fields on both of these forms.

You should be aware of how closely they are connected with each other.

2. Use the information available from Help to fill in Code, Description and Copy description to transaction. You can

also use the default settings in the header sections to get you started.

Remember that this Transaction Type should be meaningful to you and fit the way you do business. It enables

you to categorize your transactions but you must decide what categories mean something to you.

Remember that this Transaction Type should be meaningful to you and fit the way you do business. It enables

you to categorize your transactions but you must decide what categories mean something to you.

3. Make choices in the Financial Type section as needed, using the F1 Help results to guide you. The Financial Type

determines how the transaction is processed and totaled.

4. The second column of the Financial Type section pertains to the Transaction and Debtor forms. The choices set the

way information is displayed and calculated. A payment can be categorized and broken down into Interest, Fees, Adjustment

and Principal in any order you need.

If you want to see the payment breakdown for this Transaction, switch ON "Payment breakdown" in the Transaction Type

form. Several fields on the Transaction form are only visible when this switch is turned on. These fields relate to

Principal, Fees, and Interest. Review help on those topics.

If you want to see the payment breakdown for this Transaction, switch ON "Payment breakdown" in the Transaction Type

form. Several fields on the Transaction form are only visible when this switch is turned on. These fields relate to

Principal, Fees, and Interest. Review help on those topics.

The Help available when you press F1 from the Transaction form will give you a good explanation of these payment

breakdown aspects. Categorizing your transactions using payment breakdown gives you very detailed information

for reporting and tracking purposes.

The Help available when you press F1 from the Transaction form will give you a good explanation of these payment

breakdown aspects. Categorizing your transactions using payment breakdown gives you very detailed information

for reporting and tracking purposes.

5. The Processing section allows you to change the defaults for adding transaction information to statements and reports.

6. The Commission and Tax tabs give you choices for Commission and Tax calculation.

7. The Display section can hide To Us or Direct fields on the Transaction form. This makes it easier for the user to

know where to enter the dollar amount when a transaction is posted. Also, Collect! can create an Invoice or Receipt

number automatically if you switch on these settings for a particular Transaction Type. Please refer to the Help available

on Transaction for more information about numbering receipts and invoices.

8. Choose an Operator and transactions of this type will be posted to this Operator. This may be used for calculating

Operator commissions. Press the arrow in this field to display a list of operators in the system.

9. Choose a Sales ID and transactions of this type will be posted to this Sales person. This may be used for calculating

Sales commissions. Press the arrow in this field to display a list of Sales IDs in the system.

10. Choose a Contact Plan to run when transactions of this type are saved. Press the arrow in this field

to display a list of available contact plans.

POST PAYMENT EVENT SEQUENCE

The sequence of events when you post payments is:

1. A transaction record is created.

2. Debtor totals are recalculated.

3. The default payment posting Contact Plan is run.

4. The Transaction Type specific Contact Plan is run.

This plan is run AFTER any Contact Plan you use in the "default payment posting" options setup form.

This means that you can use this plan to set up a custom schedule for promised payments received or NSF checks.

This plan is run AFTER any Contact Plan you use in the "default payment posting" options setup form.

This means that you can use this plan to set up a custom schedule for promised payments received or NSF checks.

11. You can set a Commission Rate to use with this Transaction Type. This rate will be used instead

of the normal Commission Rate in the Debtor form.

Summary

Several basic transaction types are needed to handle the transactions that you post every day. You may

find that Collect! has already provided the types and settings you need to begin using transaction types.

If your needs are not met by the predefined transaction types, you can modify existing types or create your

own. Please have an idea of the transaction types that you need and the particular settings you would like to

apply before you begin to construct your own system for organizing your accounts.

Transaction Type Samples

Principal Transaction Types - This transaction type is needed if you are going to apply interest, apply a

judgment, or add more principal at a later date. If you are not using any of the above items then you can skip this transaction

type.

Interest Transaction Types - This transaction type is needed if you are applying interest or applying a

judgment with interest amounts. If you are not using any interest amounts, then you can skip this transaction type.

Payment Transaction Types - This transaction type is needed for posting all payments. Payment transactions

control all aspects of payment posting, keeping track of who is posting credits or debits to your accounts.

Legal Transaction Types - This transaction type is needed if you are applying any legal fees to the account.

These are transactions are kept together and calculated as total legal fees on an account.

Other Expenses Transaction Types - This Fees transaction type is needed if you are applying additional charges,

such as a closing fee, late fee, or a service charge, to the account. Any fee that is not a legal fee uses this transaction type.

Adjustment Transaction Types - This transaction type is needed if you are applying adjustments to Principal,

Interest, or Fees, or to adjust the Owing of any account.

Internal Transaction Types - This transaction type may be used for tracking internal expenses on a particular

account. This transaction does not affect either the Debtor's or the Client's financials in any way. It is just for keeping

track of internal expenses borne entirely by the agency.

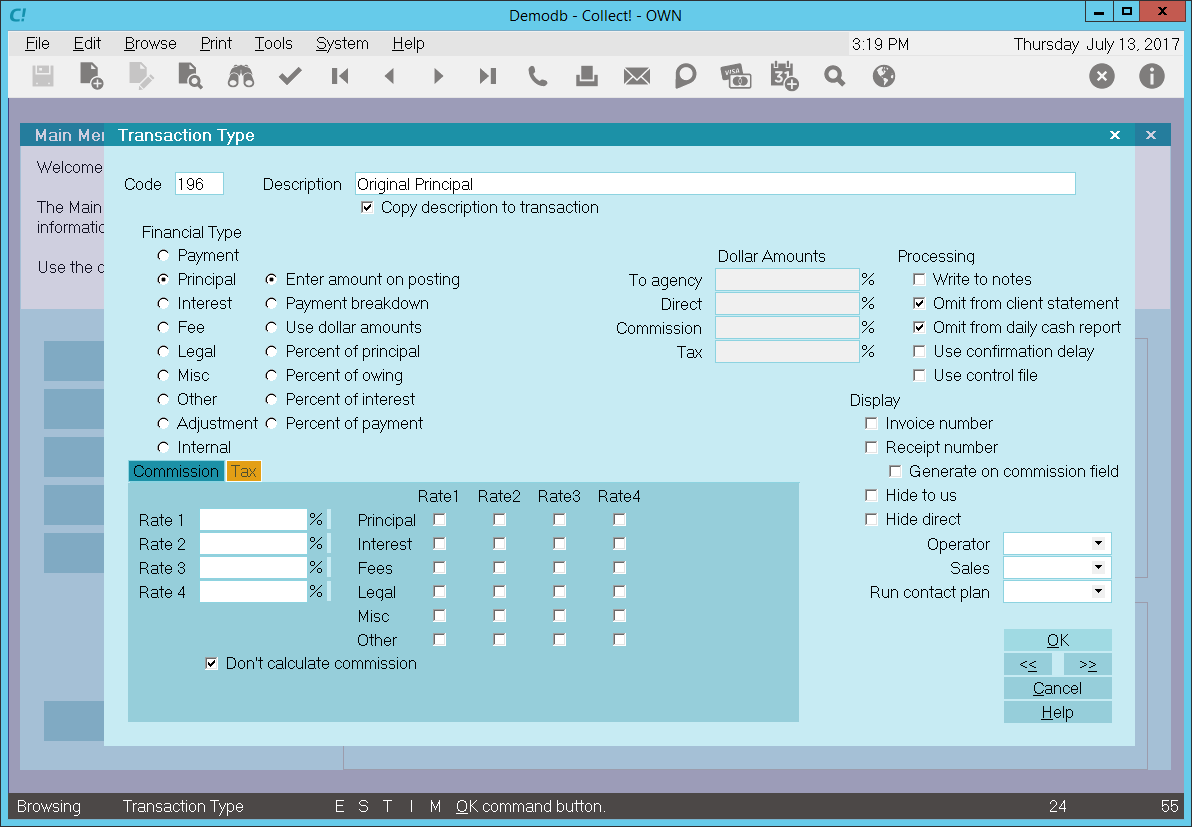

Transaction Type Sample - Original Principal

The Original Principal transaction type is needed if you are going to apply interest, apply a judgment,

or add more principal at a later date. If you are not using any of the above items, then you can skip this transaction type.

By default, Collect! ships and uses the 196 Original Principal transaction type shown below when it is required to perform

interest or judgment calculations.

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal transaction types are added

together and the total is set in the Original Principal field on the Financial Details form.

You may enter an Original Principal amount using the Financial Detail form accessed from the Debtor form's Principal

field. If you have no need of anything more complicated, this is all you have to do to record the Original Principal

for the account.

You may enter an Original Principal amount using the Financial Detail form accessed from the Debtor form's Principal

field. If you have no need of anything more complicated, this is all you have to do to record the Original Principal

for the account.

The sample shown below sets the Original Principal amount when entering a new debtor. There are several instances when you will

need this.

- If you ever intend to apply interest of any type,

- need to add more principal later,

- use Collect!'s judgment functions,

- use payment plans as a credit grantor,

then you will want to apply this transaction type to the account.

Original Principal Transaction Type 196

When you create a 196 Original Principal transaction on a debtor account, the description from the transaction

type form will be copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the time of

posting the transaction.

Entering a negative amount in either the To Us or Direct field will add to the debtor's Principal amount.

If more than one of these transaction types is posted to an account, the total will be calculated

automatically and displayed in the Principal field on the Debtor form.

Entering a positive amount will reduce the amount of Principal. Interest will be recalculated accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions, interest

is calculated on the resulting principal total after each transaction's payment date. For more details

please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 196 Original Principal

transaction to an account. You may override any setting when posting the transaction.

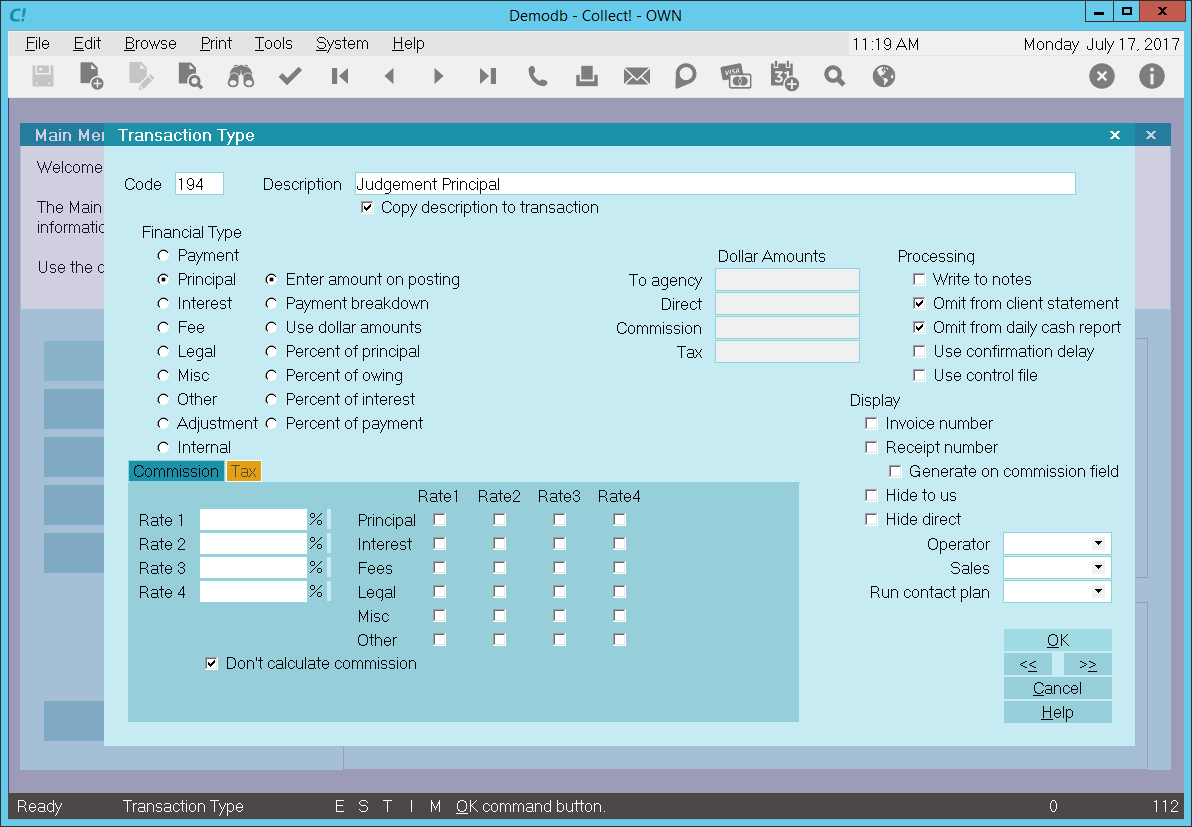

Transaction Type Sample - Judgment Principal

The Judgment Principal transaction type is needed if you are going to apply interest or add more principal at a later date.

If you are not using any of the above items, then you can skip this transaction type.

By default, Collect! ships and uses the 194 Judgment Principal transaction type shown below when it is required to perform

interest or judgment calculations.

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal transaction types are added

together and the total is set in the Judgment Principal field on the Financial Details form.

You may enter an Judgment Principal amount using the Financial Detail form accessed from the Debtor form's Principal

field. If you have no need of anything more complicated, this is all you have to do to record the Judgment Principal

for the account.

You may enter an Judgment Principal amount using the Financial Detail form accessed from the Debtor form's Principal

field. If you have no need of anything more complicated, this is all you have to do to record the Judgment Principal

for the account.

Any transactions with a Payment Date that is before the Judgment Date will be excluded from the Debtor's financial

calculations. Collect! assumes that the Judgment awarded will factor in all previous transactions.

Any transactions with a Payment Date that is before the Judgment Date will be excluded from the Debtor's financial

calculations. Collect! assumes that the Judgment awarded will factor in all previous transactions.

The sample shown below sets the Judgment Principal amount. There are several instances when you will need this.

- If you ever intend to apply interest of any type,

- need to add more principal later,

- use Collect!'s judgment functions,

- use payment plans as a credit grantor,

then you will want to apply this transaction type to the account.

Judgment Principal Transaction Type 194

When you create a 194 Judgment Principal transaction on a debtor account, the description from the transaction

type form will be copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the time of

posting the transaction.

Entering a negative amount in either the To Us or Direct field will add to the debtor's Principal amount.

If more than one of these transaction types is posted to an account, the total will be calculated

automatically and displayed in the Principal field on the Debtor form.

Entering a positive amount will reduce the amount of Principal. Interest will be recalculated accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions, interest

is calculated on the resulting principal total after each transaction's payment date. For more details

please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 194 Judgment Principal

transaction to an account. You may override any setting when posting the transaction.

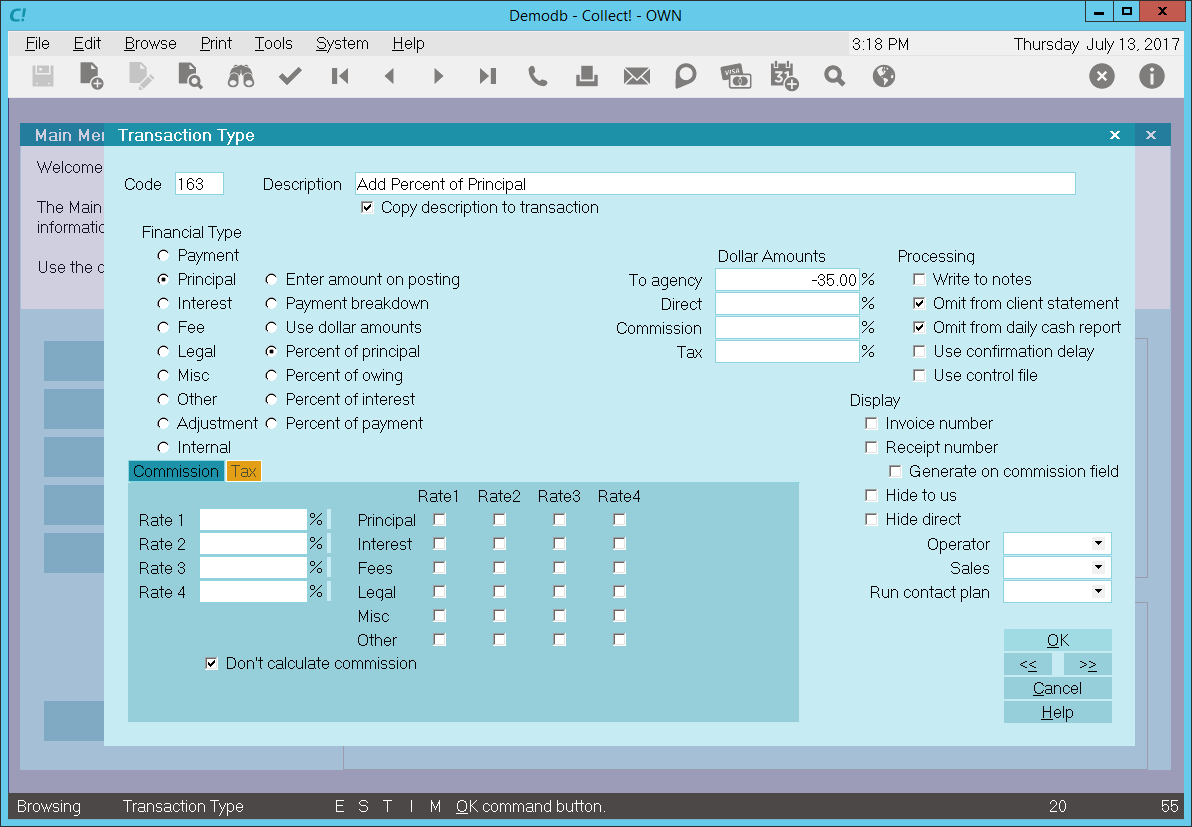

Transaction Type Sample - Add Percent Of Principal To Principal

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal transaction types are added

together and the total is set in the Original Principal field on the Financial Detail form.

The sample shown below will add 35% of the current principal to any previous principal amount. Use this transaction type to add

a percentage of the principal to the principal at the time of posting.

Percent Of Principal - Principal Transaction Type

When you post a 163, Add Percentage of Principal principal transaction to a debtor account, the

description from the transaction type form will be copied to the transaction being posted.

The 'Percent of principal' radio button is switched ON to allow you to set the percentage you wish to

be used at the time of posting the transaction. In this sample, -35% of the current principal will be

automatically filled into the To Us field when posting. Collect! will use the current Principal amount and

add 35% of this value to the previous principal posted to the account.

Entering a negative percentage in either the To Us or Direct field will add to the debtor's Principal amount.

If more than one of these transaction types is posted to an account, the total will be calculated

automatically and displayed in the Principal field on the Debtor form.

Entering a positive percentage will reduce the amount of Principal. Interest will be recalculated accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions, interest

is calculated on the resulting principal total after each transaction's payment date. For more details

please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 163 + Percent of Principal

principal transaction to an account. You may override any setting when posting the transaction.

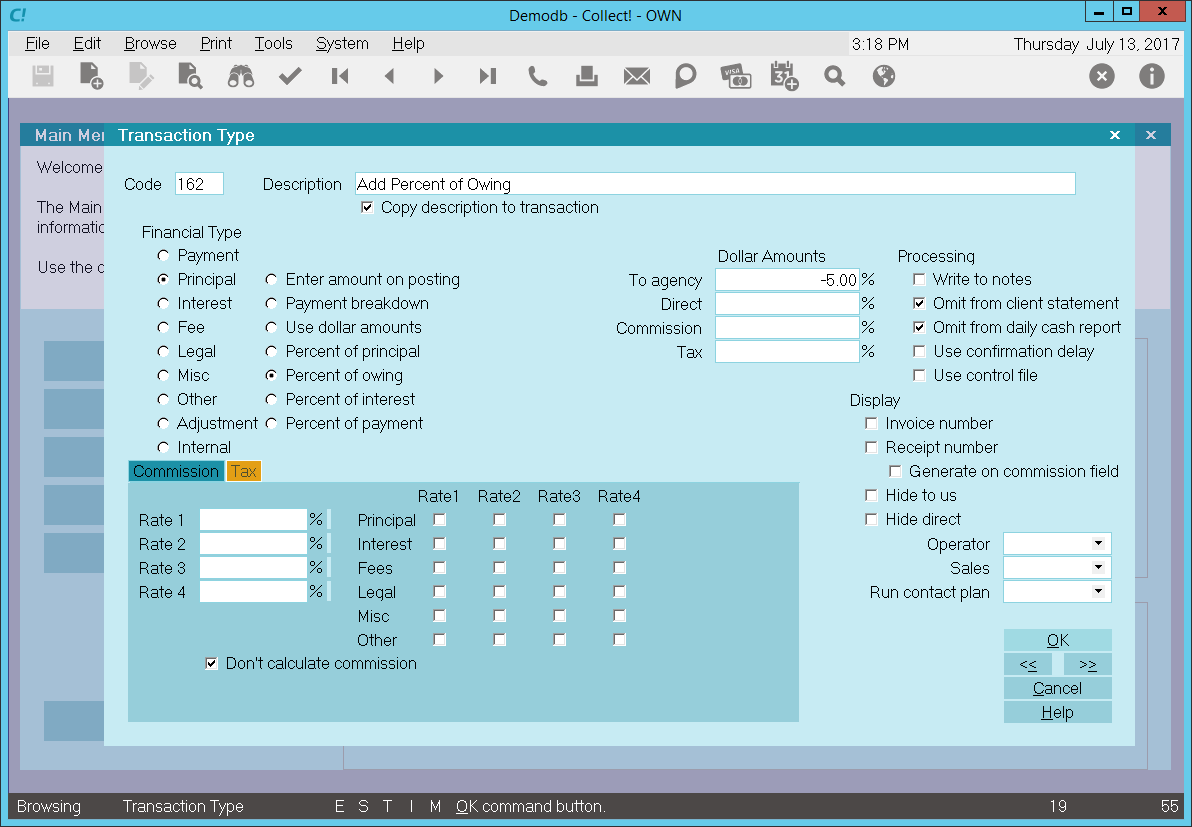

Transaction Type Sample - Add Percent Of Owing To Principal

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the

Financial Detail form.

The sample shown below will add 5% of the current Owing to any previous Principal amount. Use this

transaction type for adding to the principal a percentage of the owing at the time of posting.

Percent Of Owing - Principal Transaction Type

When you post a 162, Add Percent of Owing principal transaction to a debtor account, the description from

the transaction type form will be copied to the transaction being posted.

The 'Percent of owing' radio button is switched ON to allow you set the percentage you wish to be used at the time of posting

the transaction. In this sample, -5% of the current Owing will be automatically filled into the To Us field when posting.

Collect! will use the current Principal amount and add 5% of this value to the previous principal posted to the account.

Entering a negative percentage in either the To Us or Direct field will add to the debtor's Principal amount. If more than one

of these transaction types is posted to an account, the total will be calculated automatically and displayed in the Principal

field on the Debtor form.

Entering a positive percentage will reduce the amount of Principal. Interest will be recalculated accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions, interest

is calculated on the resulting principal total after each transaction's payment date. For more details

please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 162 + Percent of Owing

principal transaction to an account. You may override any setting when posting the transaction.

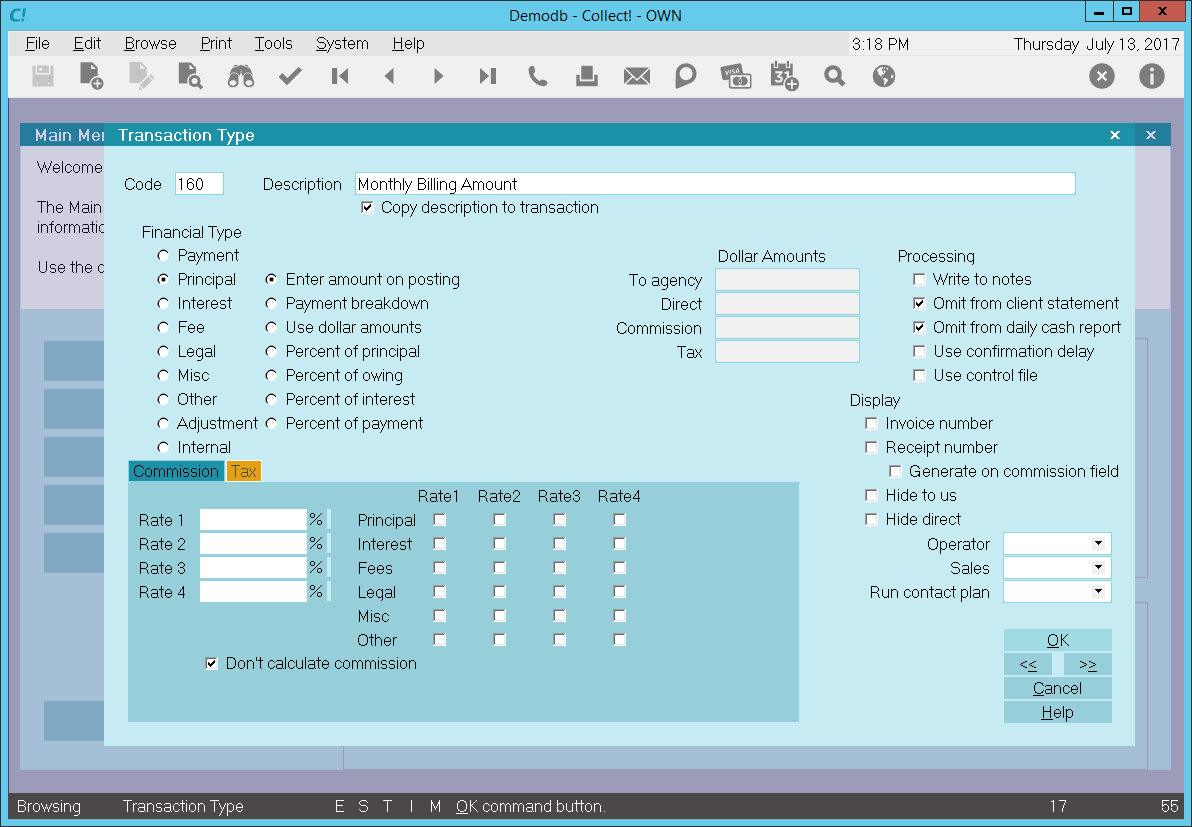

Transaction Type Sample - Additional Principal

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the

Financial Detail form.

The sample shown below will add to any previous Principal amount. Use this transaction type for adding

to the principal, for example, monthly for services or equipment. Other examples might be monthly charges

for a membership, or charging for additional services or features your company may offer.

Monthly Billing Amount - Principal Transaction Type

When posting a 160, Monthly Billing Amount principal transaction to a debtor account, the description from

the transaction type form will be copied to the transaction being posted.

The 'Use dollar amounts' radio button is switched ON to allow you set the amount you wish to be used at the time of posting the

transaction. In this sample, -$53.20 will be automatically filled into the To Us field when posting.

Entering a negative amount in either the To Us or Direct field will add to the debtor's Principal amount.

If more than one of these transaction types is posted to an account, the total will be calculated

automatically and displayed in the Principal field on the Debtor form.

Entering a positive amount will reduce the amount of Principal. Interest will be recalculated accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions, interest

is calculated on the resulting principal total after each transaction's payment date. For more details

please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 160 Monthly Billing Amount

principal transaction to an account. You may override any setting when posting the transaction.

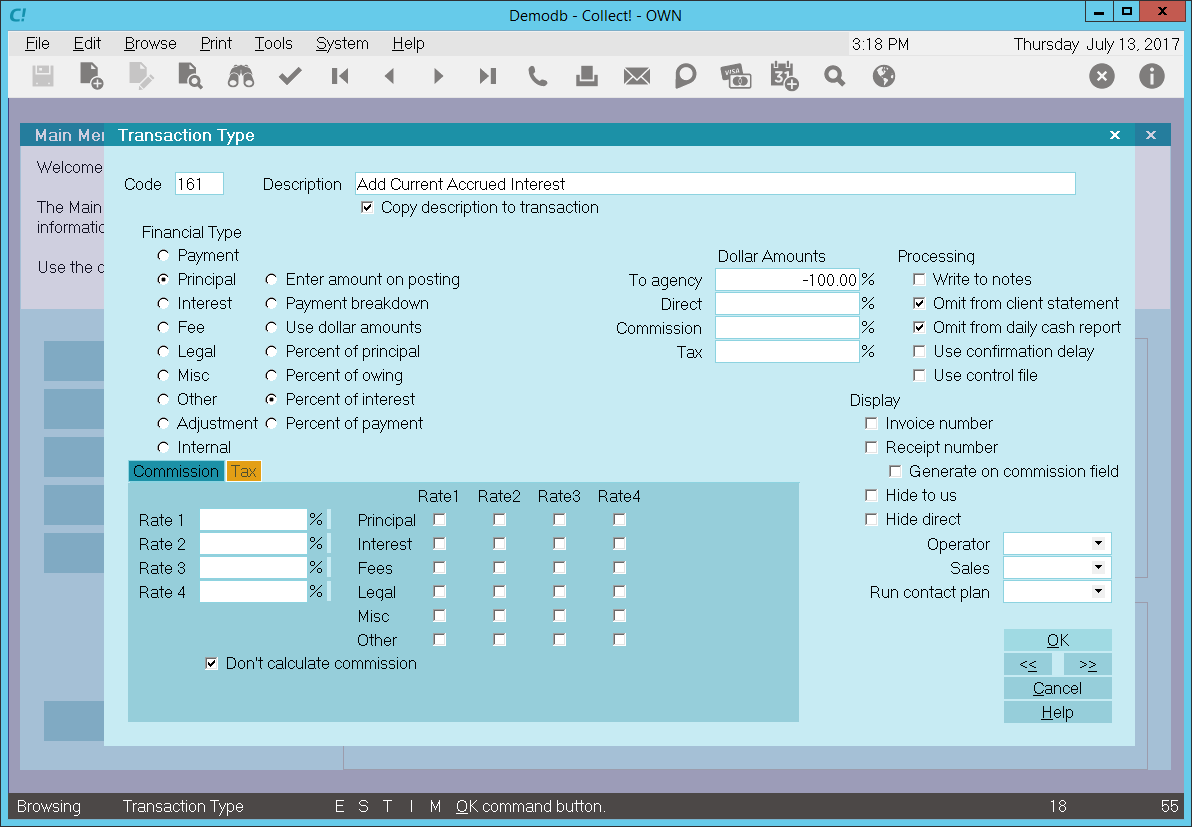

Transaction Type Sample - Add Accrued Interest To Principal

You may adjust or add to the Principal amount using Principal transaction types. Multiple principal

transaction types are added together and the total is set in the Original Principal field on the Financial Detail form.

The sample shown below will add the total outstanding Accrued Interest to any previous Principal amount.

Use this transaction type to add to the Principal the monthly outstanding accrued interest.

Accrued Interest - Principal Transaction Type

When posting a 161, Add Current Accrued Interest principal transaction to a debtor account, the description from

the transaction type form will be copied to the transaction being posted.

The 'Percent of Interest' radio button is switched ON to allow you set the amount you wish to be used at the time of posting

the transaction. In this sample, -100% will be automatically filled into the To Us field when posting. Collect! will use the

current Accrued Interest amount and add 100% of this value to the previous Principal posted to the account.

Entering a negative percentage in either the To Us or Direct field will add to the debtor's Principal amount.

If more than one of these transaction types is posted to an account, the total will be calculated

automatically and displayed in the Principal field on the Debtor form.

Entering a positive percentage will reduce the amount of Principal. Interest will be recalculated accordingly.

Interest, if used, is calculated from the Payment Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you are using multiple principal transactions, interest

is calculated on the resulting principal total after each transaction's payment date. For more details

please see Interest Detail and documentation for specific types of interest.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the daily cash report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 161 + Current Accrued Interest

principal transaction to an account. You may override any setting when posting the transaction.

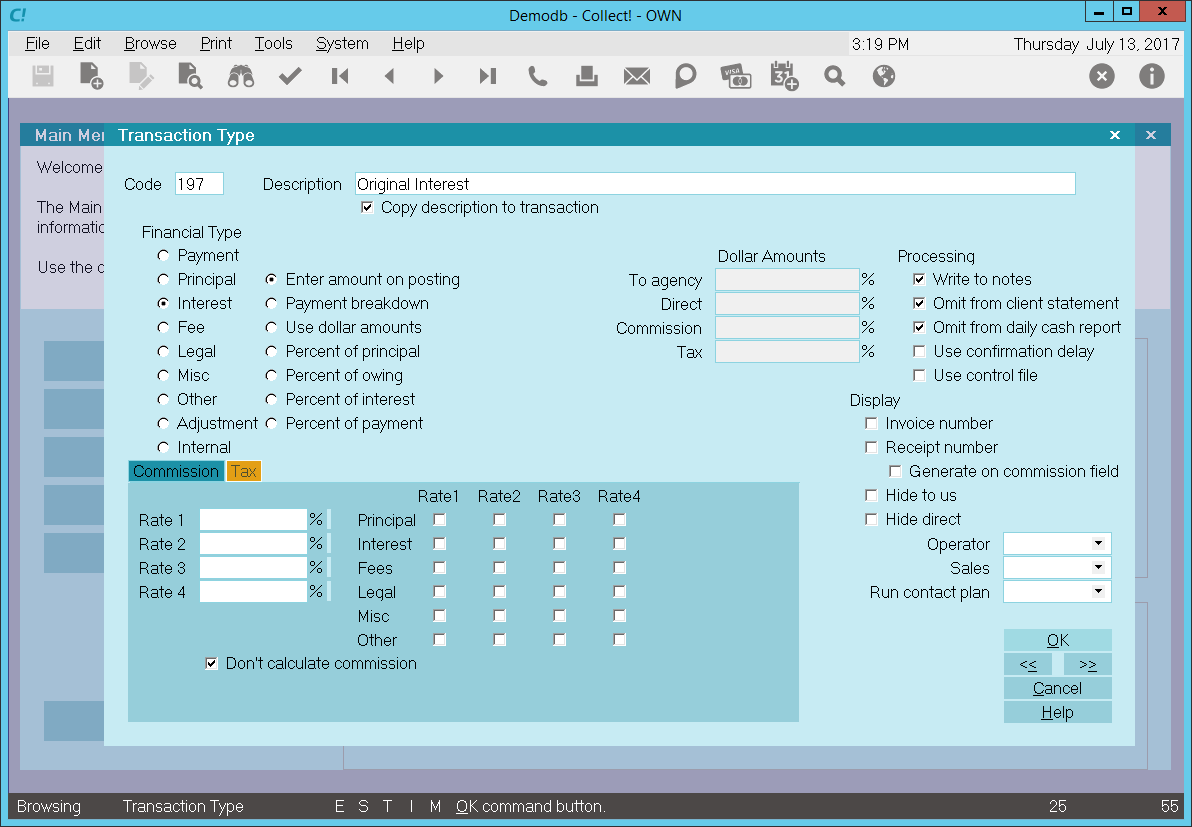

Transaction Type Sample - Original Interest

The Original Interest Transaction Type is needed to keep track of any original interest charged

to the account prior to receiving the account. If you do not need to keep this information separate, then

you can skip this transaction type.

By default, Collect! ships and uses the 197 Original Interest transaction type shown below when it is

required to post an original interest amount.

You may adjust or add to the Interest amount using Interest transaction types other than the 197 Original Interest transaction

type. Unlike Principal transactions, only the first original interest transaction type will populate the Original Interest field

on the Interest Details form. Any other 197 original transaction types will be ignored.

If you need to apply only original interest and no further interest, you may enter an Original Interest amount using

the Interest Details form accessed from the Debtor form's Interest field. If you have no need of anything more

complicated, this is all you have to do to record Original Interest for the account.

For those users who use a more detailed or complex reporting method, posting an Original interest transaction

provides more information about the interest amount. With a transaction you can set Payment and Posted Dates,

choose to show or not show the transaction on statements, and assign operator ID's for tracking and commission purposes.

Original Interest - Interest Transaction Type

When you create a 197 Original Interest transaction on a debtor account, the Description from the

Transaction Type form is copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the time of posting the

transaction.

Entering a negative amount in either the To Us or Direct field adds to the debtor's Original Interest

amount. The amount will be set in the Interest Details Original Interest field and displays as a positive amount.

Entering a positive amount reduces the amount of Original Interest. Interest will be recalculated accordingly.

*** WARNING - If more than one Original Interest transaction types is posted to an account, only the first original interest

transaction will be displayed in the Original Interest field.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the Daily Cash Report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 197 Original Interest transaction

to an account. You may override any setting when posting the transaction.

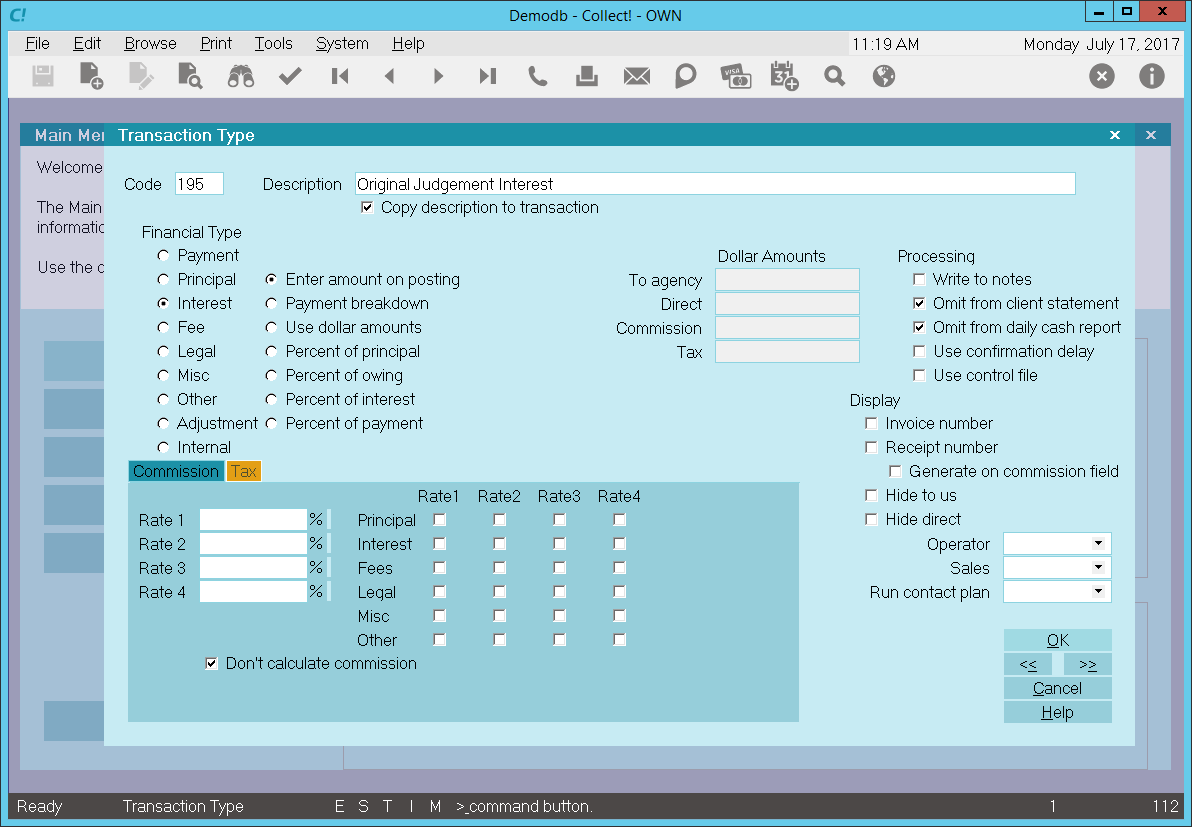

Transaction Type Sample - Original Judgment Interest

The Original Judgement Interest Transaction Type is needed to keep track of any original judgement interest charged

to the account as part of the Judgement. If you do not need to keep this information separate, then

you can skip this transaction type.

By default, Collect! ships and uses the 195 Original Judgement Interest transaction type shown below when it is

required to post an original judgement interest amount.

You may adjust or add to the Interest amount using Interest transaction types other than the 195 Original Judgement Interest

transaction type. Unlike Principal transactions, only the first original interest transaction type will populate the Original

Judgement Interest field on the Financial Details form. Any other 195 original transaction types will be ignored.

If you need to apply only original interest and no further interest, you may enter an Original Judgement Interest amount using

the Financial Details form accessed from the Debtor form's Principal field. If you have no need of anything more

complicated, this is all you have to do to record Original Judgement Interest for the account.

For those users who use a more detailed or complex reporting method, posting an Original Judgement Interest transaction

provides more information about the interest amount. With a transaction you can set Payment and Posted Dates,

choose to show or not show the transaction on statements, and assign operator ID's for tracking and commission purposes.

Original Judgment Interest - Interest Transaction Type

When you create a 195 Original Judgment Interest transaction on a debtor account, the Description from the

Transaction Type form is copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched ON to allow you to enter the amount at the time of posting the

transaction.

Entering a negative amount in either the To Us or Direct field adds to the debtor's Original Interest

amount. The amount will be set in the Interest Details Original Interest field and displays as a positive amount.

Entering a positive amount reduces the amount of Original Judgment Interest. Interest will be recalculated accordingly.

*** WARNING - If more than one Original Judgment Interest transaction types is posted to an account, only the first original

interest transaction will be displayed in the Original Judgment Interest field.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the Daily Cash Report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 195 Original Judgment Interest transaction

to an account. You may override any setting when posting the transaction.

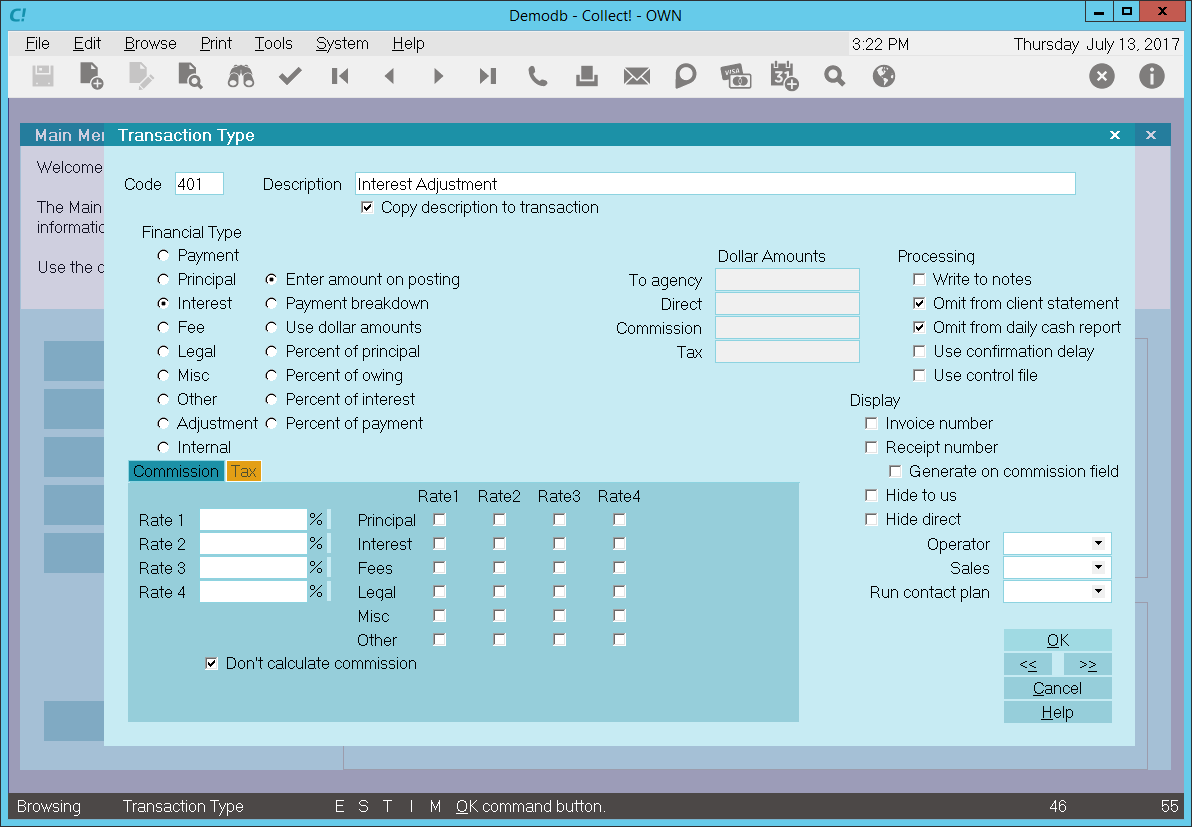

Transaction Type Sample - Interest Adjustment

You may adjust or add to the interest amount using Interest Transaction Types. Multiple interest

transaction types are added together and the total is set in the Interest field on the Debtor form.

Collect! ships with a default Interest Adjustment transaction type 401. Use this transaction type

to adjust the Interest amount for an account.

Interest Adjustment - Interest Transaction Type

When posting a 401, Interest Adjustment transaction to a Debtor account, the Description from the Transaction

Type form is copied to the transaction being posted.

The 'Enter amount on Posting' radio button is switched ON to allow you enter the amount you wish to be used

at the time of posting the transaction.

Entering a negative amount in either the To Us or Direct field adds to the debtor's Interest amount.

Entering a positive amount reduces the amount of Interest on the debtor's account. Interest will be recalculated accordingly.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the Daily Cash Report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 401 Interest Adjustment transaction

to an account. You may override any setting when posting the transaction.

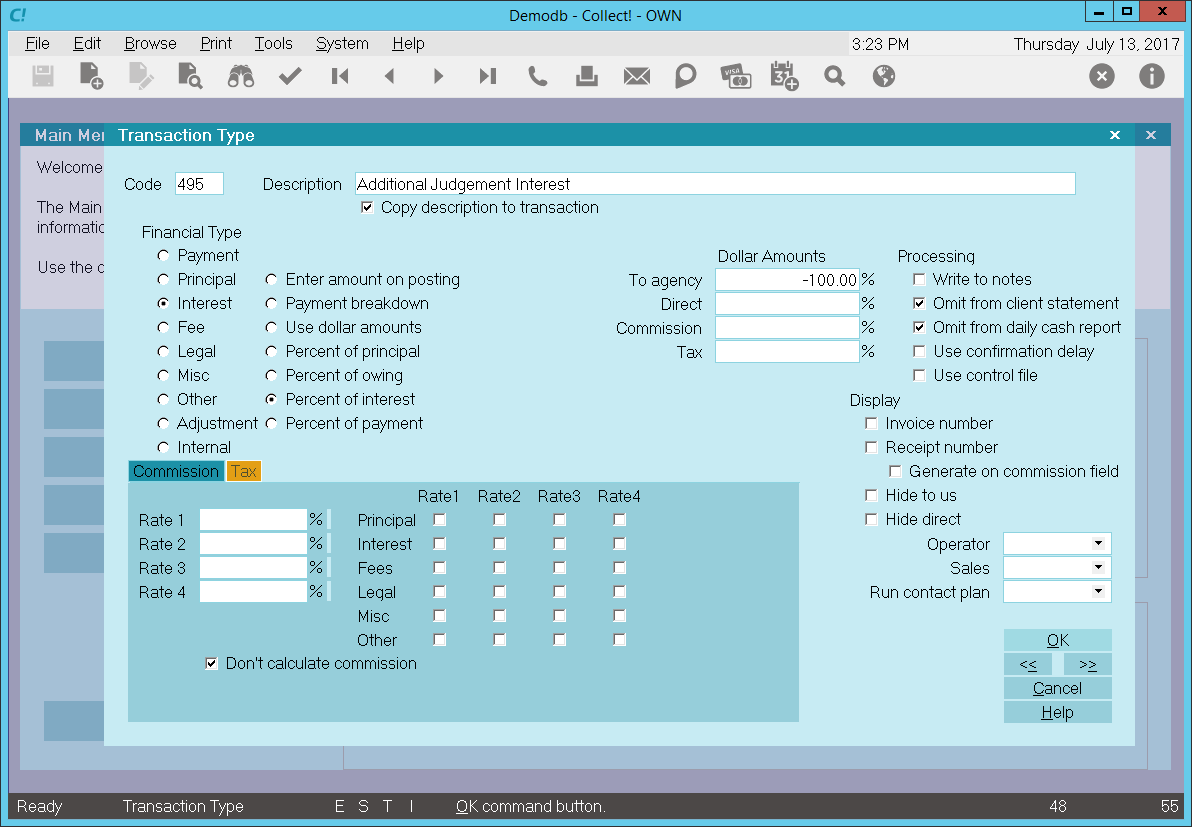

Transaction Type Sample - Total Accrued Interest

You may adjust or add to the interest amount using Interest Transaction Types. You may use this transaction type sample to get

the total outstanding accrued interest before closing an account, or when you wish to turn off interest calculations in the

future.

By default, if you close an account, Collect! uses the default Total Accrued Interest transaction type 499 to capture the amount

of outstanding accrued interest. The 499 transaction is posted to the debtor, interest calculating is switched off and the

'Calculate Interest From Date' is reset to today's date. This is set in case you want to start calculating interest again in the

future.

The sample shown below will add the total outstanding accrued Interest to any previous interest amount.

Total Accrued Interest - Interest Transaction Type

When posting a 499, Total Accrued Interest transaction to a debtor account, the Description from the Transaction Type

form is copied to the transaction being posted.

The 'Percent of Interest' radio button is switched ON to allow you set the amount you wish to be used at the time

of posting the transaction. In this sample, -100% will be automatically filled into the To Us field when posting.

Collect! uses the current Accrued Interest amount and adds 100% of this value to the previous interest posted to the account.

Entering a negative percentage in either the To Us or Direct field adds to the debtor's Interest amount.

Entering a positive percentage reduces the amount of Interest. Interest will be recalculated accordingly.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your Client and also to omit the transaction when generating the Daily Cash Report.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a

statement for your client and also to omit the transaction when generating the Daily Cash Report.

Calculations are checked not to calculate commission and not to calculate tax on any commission amount present.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 499 Total Accrued Interest

transaction to an account. You may override any setting when posting the transaction.

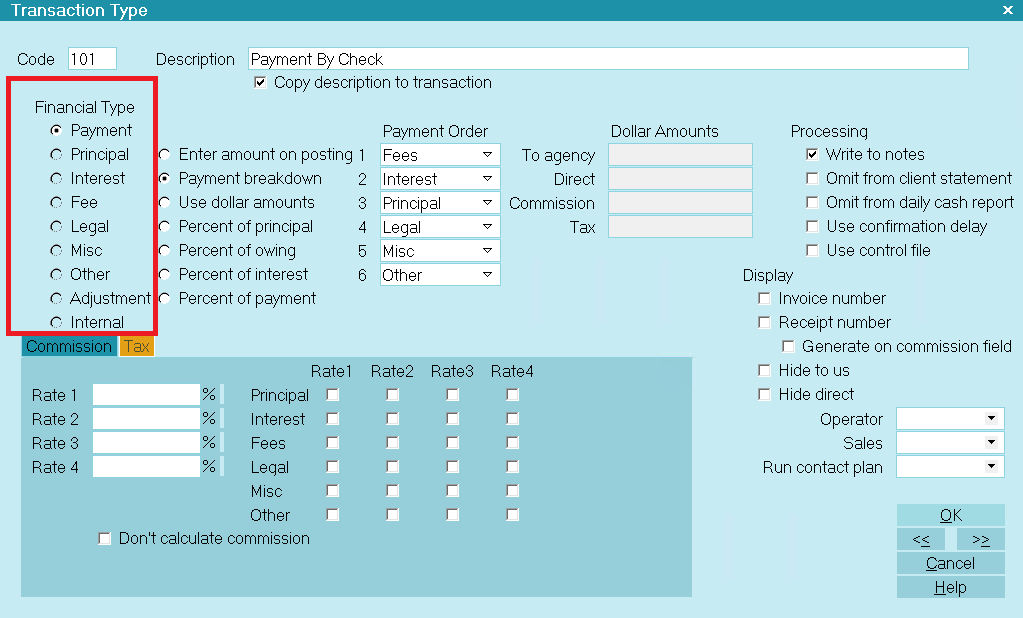

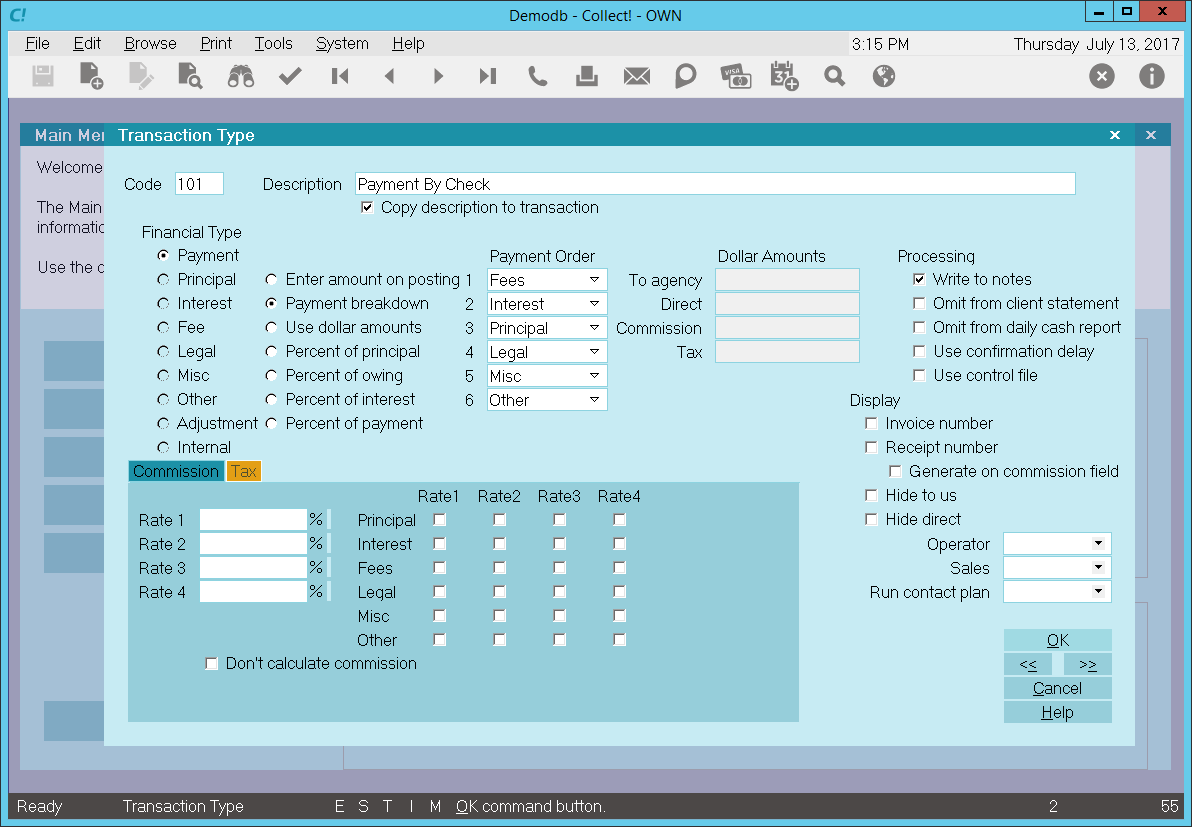

Transaction Type Sample - Payment By Check

The Payment By Check Transaction Type may be used to post a check payment to an account.

The screen shot below shows the settings for the Payment By Check Transaction Type.

Payment By Check - Payment Transaction Type

The rest of this document explains the settings shown above.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different payment transaction types for separating the various types of payments you may receive.

Payment By Cash, Payment By Check, Money Order and Check Payment Taken Over The Phone are a few examples.

A check mark in the box labeled Copy Description To Transaction copies the Description from the

Transaction Type form when you post a 101 Payment By Check transaction.

The Payment radio button is dotted for keeping track of payments made on an account.

Any transaction flagged as a Payment type, with an amount either in the To Us or Direct field, will affect the

balance of the Owing amount displayed on the Debtor form.

An amount in the transaction's Commission field affects the commission amount shown on the statement you generate for your

client.

All payment transactions are totaled together and subtracted from the total debt. The result is displayed in

the Owing field of the Debtor form.

The radio button labeled Enter amount on Posting is switched ON so you can enter an

amount when you post the payment transaction to the account.

Reporting check boxes are left UNCHECKED so that this payment transaction is included in the client

statement and the amount of the payment is calculated into the total daily cash received by your agency.

Calculations check boxes are left UNCHECKED so that commission will be calculated on this payment using

the commission rate on the account and tax will be calculated on this payment using the tax rate on the account.

The way you handle your business will help you decide whether or not to enable any other optional settings.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction or

Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction type. You may want

to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and sales operator ID's on every

transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 101 Payment By Check transaction to an account.

You may override any setting when posting the transaction.

The Payment By Check transaction type has been set up to easily post check payments to an account. When the transaction is

posted, you will be able to enter the amount of the payment as a POSITIVE value in the transaction's To Us or Direct field.

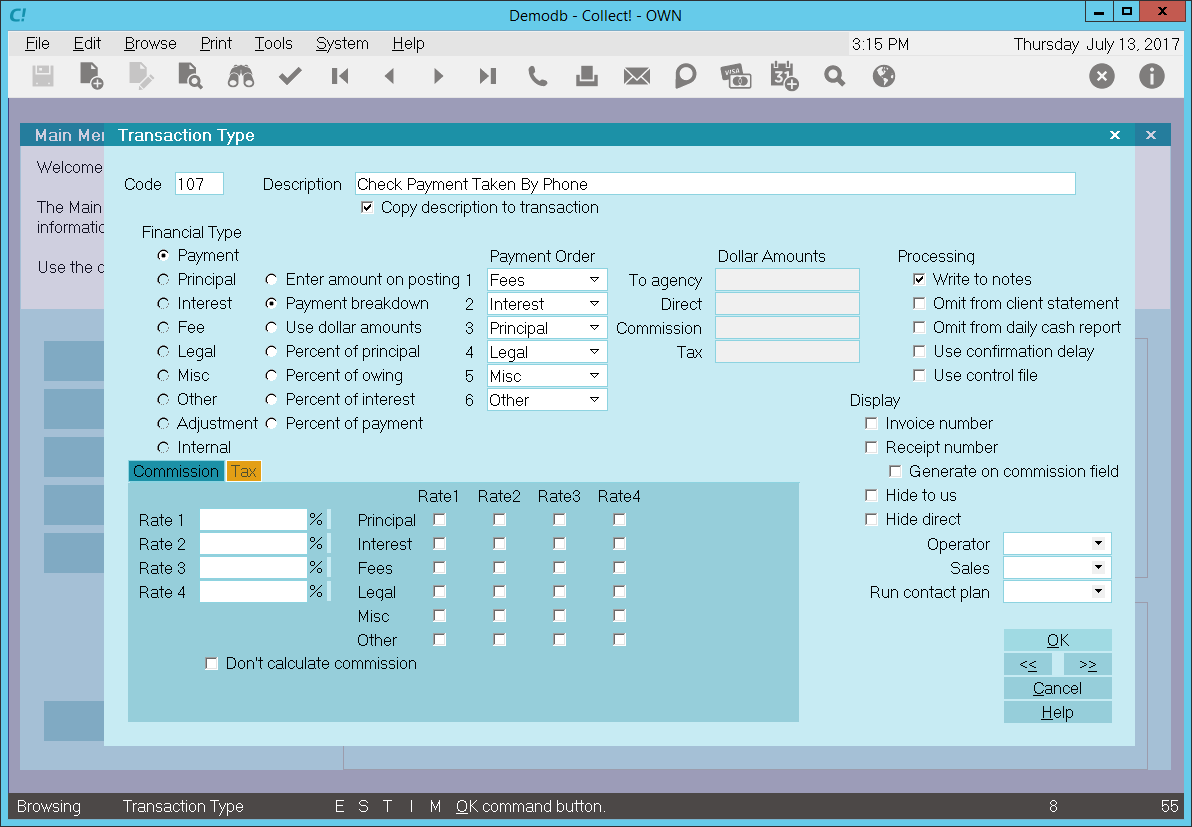

Transaction Type Sample - Check Taken By Phone

The Check Taken By Phone Transaction Type may be used to post a check payment to an account where the debtor has provided you

the banking information and you need to print the check yourself.

The screen shot below shows the settings for the Check Taken by Phone Transaction Type.

Check Taken by Phone - Payment Transaction Type

The rest of this document explains the settings shown above.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different payment transaction types for separating the various types of payments you may receive.

Payment By Cash, Payment By Check, Money Order and Check Payment Taken Over The Phone are a few examples.

A check mark in the box labeled Copy Description To Transaction copies the Description from the

Transaction Type form when you post a 101 Payment By Check transaction.

The Payment radio button is dotted for keeping track of payments made on an account.

Any transaction flagged as a Payment type, with an amount either in the To Us or Direct field, will affect the

balance of the Owing amount displayed on the Debtor form.

An amount in the transaction's Commission field affects the commission amount shown on the statement you generate for your

client.

All payment transactions are totaled together and subtracted from the total debt. The result is displayed in

the Owing field of the Debtor form.

The radio button labeled Enter amount on Posting is switched ON so you can enter an

amount when you post the payment transaction to the account.

Reporting check boxes are left UNCHECKED so that this payment transaction is included in the client

statement and the amount of the payment is calculated into the total daily cash received by your agency.

Calculations check boxes are left UNCHECKED so that commission will be calculated on this payment using

the commission rate on the account and tax will be calculated on this payment using the tax rate on the account.

The way you handle your business will help you decide whether or not to enable any other optional settings.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction or

Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction type. You may want

to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and sales operator ID's on every

transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 101 Payment By Check transaction to an account.

You may override any setting when posting the transaction.

The Payment By Check transaction type has been set up to easily post check payments to an account. When the transaction is

posted, you will be able to enter the amount of the payment as a POSITIVE value in the transaction's To Us or Direct field.

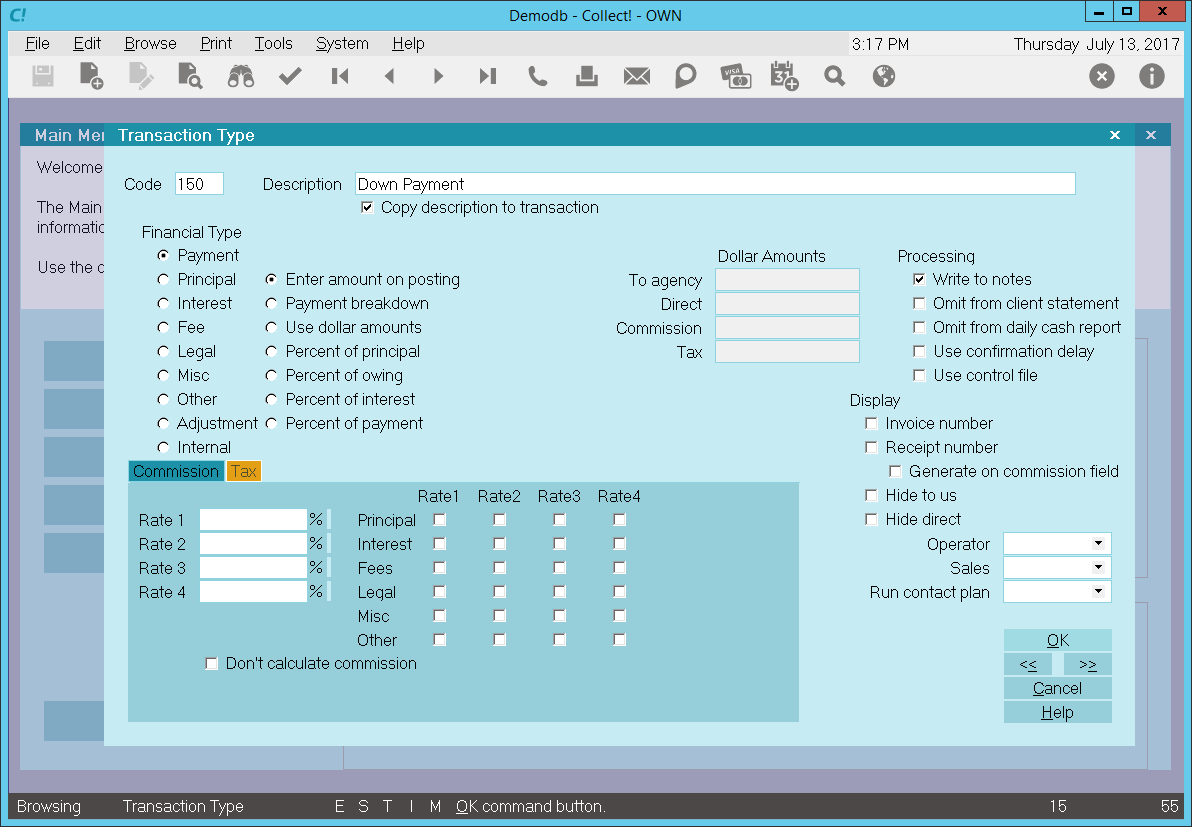

Transaction Type Sample - Down Payment

The Down Payment Transaction Type may be used to post a down payment to an account when a payment schedule is posted.

The screen shot below shows the settings for the Down Payment Transaction Type.

Down Payment - Payment Transaction Type

The rest of this document explains the settings shown above.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different payment transaction types for separating the various types of payments you may receive. The Down

Payment transaction type is typically used when setting up loans or payment plans. If the set up includes a down payment,

Collect! will post the dollar amount using a 150 Down Payment transaction, when you post the payment schedule to the account.

A check mark in the box labeled Copy Description To Transaction copies the Description from the

Transaction Type form when you post a 150 Down Payment transaction.

The Payment radio button is dotted for keeping track of payments made on an account.

Any transaction flagged as a Payment type, with an amount either in the To Us or Direct field, will affect the

balance of the Owing amount displayed on the Debtor form. An amount in the transaction's Commission field affects

the commission amount shown on the statement you generate for your client. All payment transactions are totaled

together and subtracted from the total debt. The result is displayed in the Owing field of the Debtor form.

The radio button labeled Enter amount on Posting is switched ON. This enabled Collect!

to fill in the dollar amount set up on the account as a down payment.

The reporting check box, Omit from client statement is left UNCHECKED so that

this payment transaction is included in the client statement.

Reporting check box, Omit from daily cash report, is left UNCHECKED so that the amount of this payment is

calculated into the total daily cash received by your agency.

Calculations check box, Don't calculate commission is left UNCHECKED so that commission will be calculated

on this payment using the commission rate on the account.

Calculations check box, Don't calculate tax is left UNCHECKED so that tax will be calculated on this

payment using the tax rate on the account.

The way you handle your business will help you decide whether or not to enable any other optional settings.

The way you handle your business will help you decide whether or not to enable any other optional settings.

A line will be written to the debtor's Notes when this Down Payment transaction is posted.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 150 Down Payment transaction to an account.

The Down Payment transaction type has been set up to handle down payments when a payment schedule

is posted to an account. The amount of the down payment is filled in automatically from the account's financial settings.

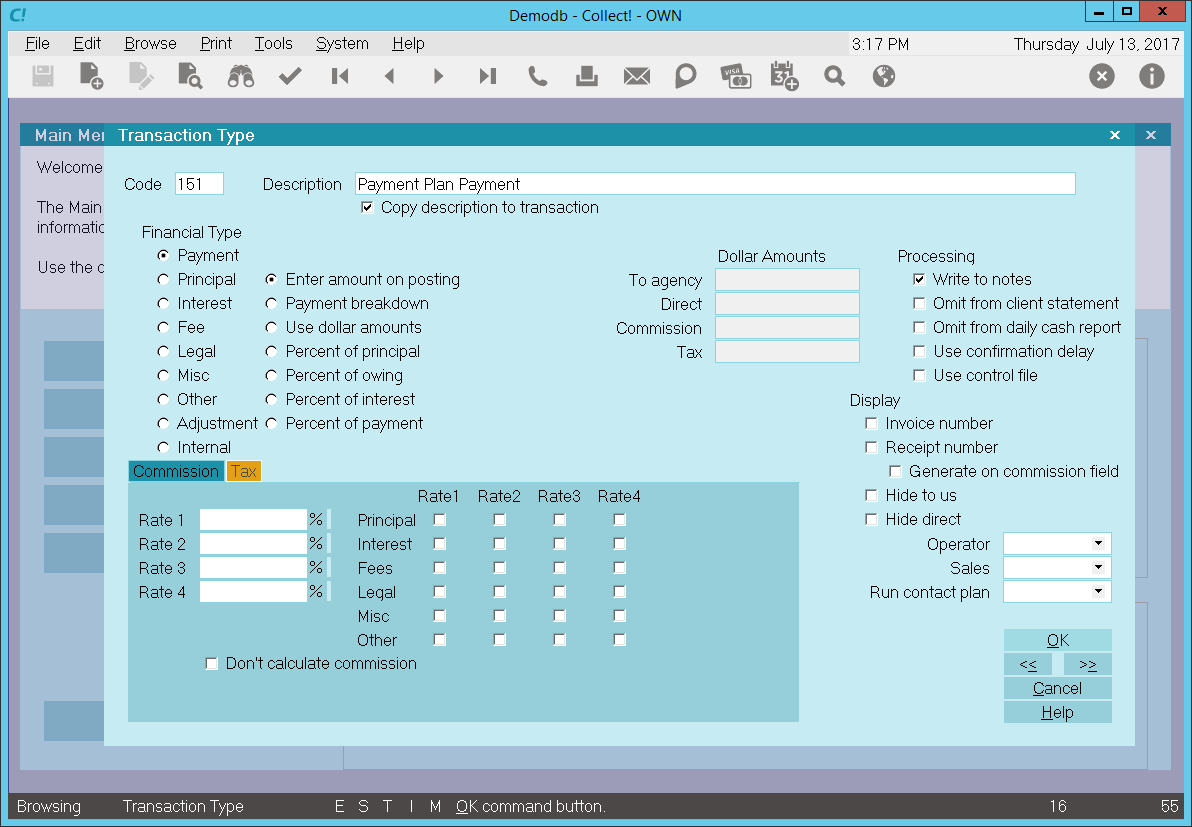

Transaction Type Sample - Payment Plan Payment

The Payment Plan Payment Transaction Type may be used to post a payment schedule to an account when using

payment plans or other scheduled loan payments.

The screen shot below shows the settings for the Payment Plan Payment Transaction Type.

Payment Plan Payment Transaction Type

The rest of this document explains the settings shown above.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different payment transaction types for separating the various types of payments you may receive.

The Payment Plan Payment transaction type is typically used when setting up loans or payment plans. When Collect! posts

all the promised transactions that make up the schedule of payments, the 151 Payment Plan Payment transaction type is used.

A check mark in the box labeled Copy Description To Transaction copies the Description from the

Transaction Type form when you post a 151 Payment Plan Payment transaction.

The Payment radio button is dotted for keeping track of payments made on an account.

Any transaction flagged as a Payment type, with an amount either in the To Us or Direct field, will affect the

balance of the Owing amount displayed on the Debtor form. An amount in the transaction's Commission field affects

the commission amount shown on the statement you generate for your client. All payment transactions are totaled

together and subtracted from the total debt. The result is displayed in the Owing field of the Debtor form.

The radio button labeled Enter amount on Posting is switched ON. This enabled Collect!

to fill in the dollar amount set up on the account as the payment amount.

The reporting check box, Omit from client statement is left UNCHECKED so that

this payment transaction is included in the client statement.

Reporting check box, Omit from daily cash report, is left UNCHECKED so that the amount of this payment is

calculated into the total daily cash received by your agency.

Calculations check box, Don't calculate commission is left UNCHECKED so that commission will be calculated

on this payment using the commission rate on the account.

Calculations check box, Don't calculate tax is left UNCHECKED so that tax will be calculated on this

payment using the tax rate on the account.

The way you handle your business will help you decide whether or not to enable any other optional settings.

The way you handle your business will help you decide whether or not to enable any other optional settings.

A line will be written to the debtor's Notes when this Down Payment transaction is posted.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 151 Payment Plan Payment to an account.

The Payment Plan Payment transaction type has been set up to handle scheduled payments when a payment plan

is posted to an account. The amount of each payment is filled in automatically from the account's financial settings.

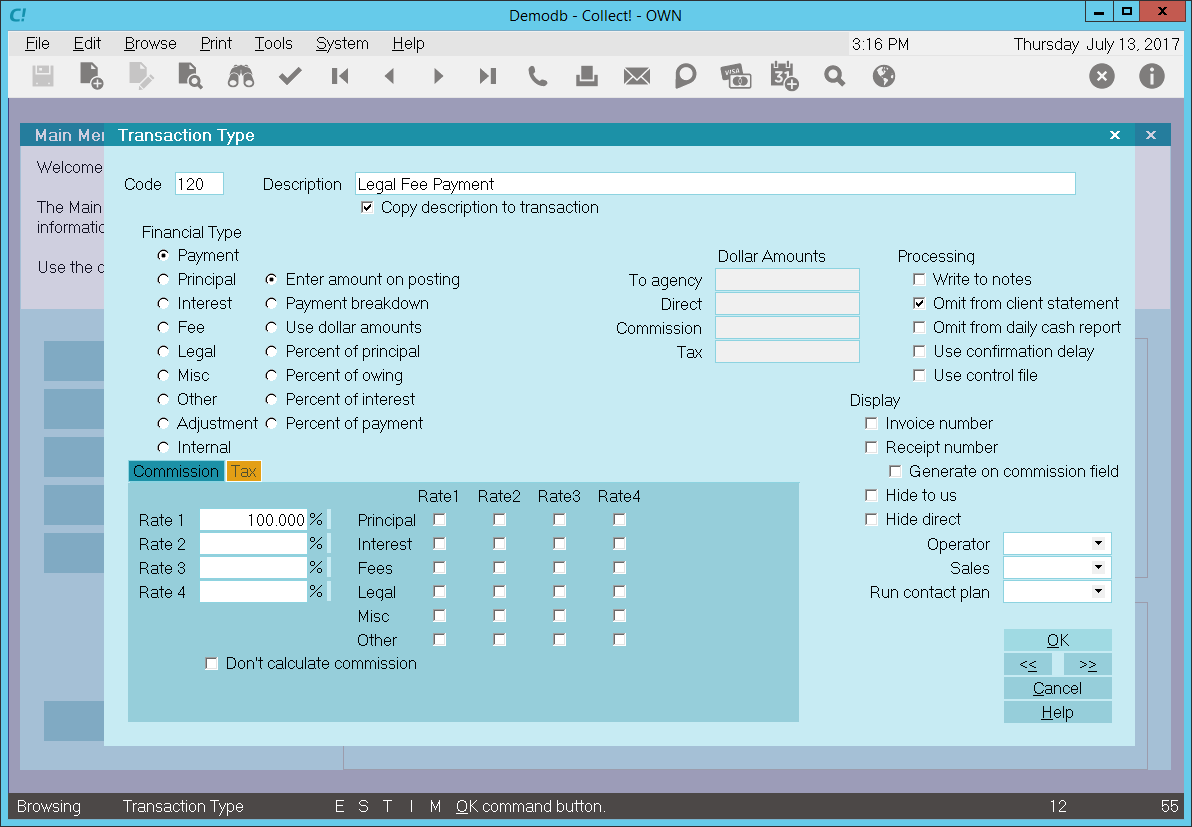

Transaction Type Sample - Legal Fee Payment

The Payment Transaction Type is needed to keep track of fees that have been paid on an account. Any transaction flagged as a

Payment type, with an amount either in the To Us or Direct field, will affect the balance of the Owing amount displayed on the

Debtor form. An amount in the transaction's Commission field affects only the commission amount shown on the statement you

generate for your client.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different legal fee payment transaction types for separating the various legal fees you may have entered.

Filing Fee, Serving Fee, and Warrant Fee are a few examples.

Legal Fee Payment - Payment Transaction Type

All payment transactions are totaled together and subtracted from the total debt the result is displayed in the Owing field of

the Debtor form.

When you create a 120 Legal Fee Payment transaction on a debtor account, the Description from the Transaction Type form is copied

to the transaction being posted.

The 'Enter amount on Posting' radio button is switched ON to allow you enter the amount you wish to be used at the time of

posting the transaction.

Entering a positive amount in either the To Us or Direct field will reflect the amount of the legal fee that has been paid.

In this sample, the reporting check boxes tell Collect! to omit this transaction when creating a statement for your client.

However the 'Omit from daily cash' is not checked as we want to keep track of the amount of money that has come into our agency

on our daily cash.

Calculations are all unchecked as we do want to calculate commission and we do want to calculate tax.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction or Transactions

List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction type. You may want

to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and sales operator ID's on every

transaction.

No contact plans have been set to be run when posting this transaction type.

We will need to input a commission rate of 100.00 as we will be retaining 100% of this payment.

All the above settings will be automatically filled in for you when you post a 120 Legal Fee Payment transaction to an account.

You may override any setting when posting the transaction.

Transaction Type Sample - Legal Fee Advance Received

The Payment Transaction Type is needed to keep track of fees that have been paid on an account. Any transaction flagged as a

Payment type, with an amount either in the To Us or Direct field, will affect the balance of the Owing amount displayed on the

Debtor form. An amount in the transaction's Commission Amount field affects only the commission amount shown on the statement you

generate for your client.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different legal fee payment transaction types for separating the various legal fees you may have entered. The

Legal Fee Advance Received transaction type is used to keep track of monies received from your client to cover legal fees, such a

s

court costs.

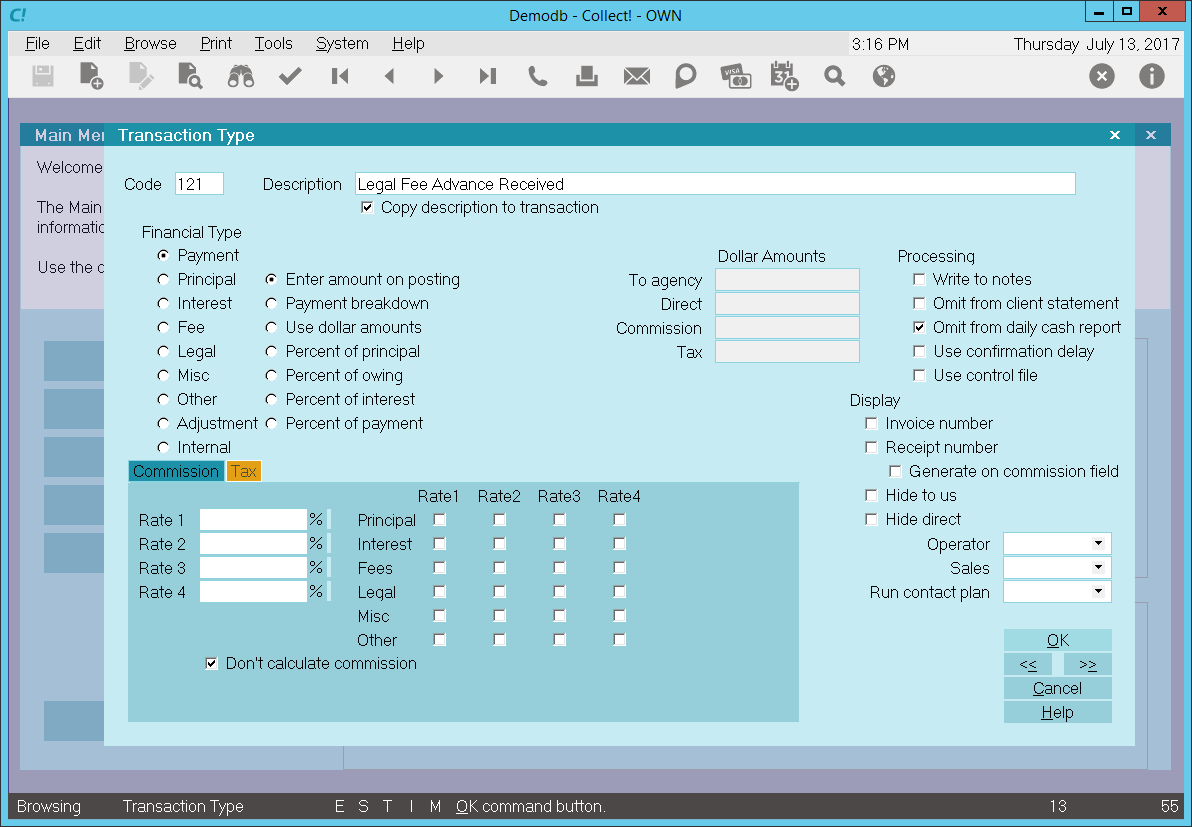

Legal Fee Advance Received - Payment Transaction Type

All payment transactions are totaled together and subtracted from the total debt the result is displayed in the Owing field of

the Debtor form.

When you create a 121 Legal Fee Advance Received transaction on a debtor account, the Description from the Transaction Type form

is copied to the transaction being posted.

The 'Enter amount on Posting' radio button is switched ON to allow you enter the amount you wish to be used at the time of

posting the transaction.

Entering a NEGATIVE amount in the Commission Amount field posts this as an advance received from your client.

In this sample, the reporting check boxes tell Collect! to include this transaction when creating a statement for your client.

However the 'Omit from daily cash' is checked as this is not included in the money that has come into our agency on our daily

cash.

Calculations are all unchecked as we do want to calculate commission and we do want to calculate tax.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction type. You may want

to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and sales operator ID's on every

transaction.

No contact plans have been set to be run when posting this transaction type.

All the above settings will be automatically filled in for you when you post a 121 Legal Fee Advance Received transaction to an

account. You may override any setting when posting the transaction.

Transaction Type Sample - Legal Fee Advance Recovered

The Payment Transaction Type is needed to keep track of fees that have been paid on an account. Any transaction flagged as a

Payment type, with an amount either in the To Us or Direct field, will affect the balance of the Owing amount displayed on the

Debtor form. An amount in the transaction's Commission Amount field affects only the commission amount shown on the statement you

generate for your client.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different legal fee payment transaction types for separating the various legal fees you may have entered. The

Legal Fee Advance Recovered transaction type is used to post a payment for legal fees, such as court costs. This is used when you

have already received an advance from your client and you need to reimburse the client for the amount of the advance. When you

recover the amount from your debtor, you may post a Legal Fee Advance Recovered payment transaction.

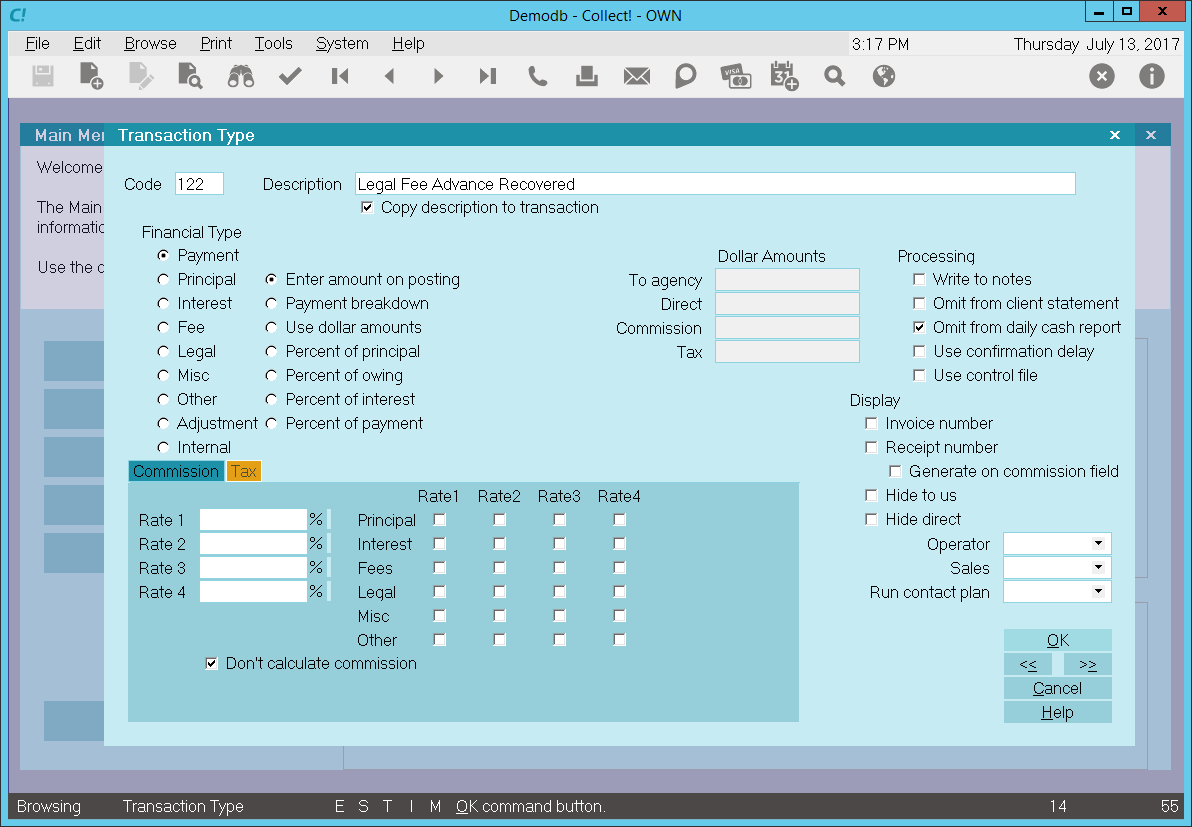

Legal Fee Advance Recovered - Payment Transaction Type

All payment transactions are totaled together and subtracted from the total debt the result is displayed in the Owing field of

the Debtor form.

When you create a 122 Legal Fee Advance Recovered transaction on a debtor account, the Description from the

Transaction Type form is copied to the transaction being posted.

The 'Enter amount on Posting' radio button is switched ON to allow you enter the amount you wish to be used at the time of

posting the transaction.

Entering a POSITIVE amount in either the To Us or Direct field will reflect the amount of the legal fee that has been recovered.

Leave the Commission Amount field empty so that the entire amount is reimbursed to your client.

In this sample, the reporting check boxes tell Collect! to include this transaction when creating a statement for your client.

However the 'Omit from daily cash' is checked as this is not included in the money that has come into our agency on our daily

cash.

Calculations are all unchecked as we do want to calculate commission and we do want to calculate tax.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction type. You may want

to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and sales operator ID's on every

transaction.

No contact plans have been set to be run when posting this transaction type.

All the above settings will be automatically filled in for you when you post a 122 Legal Fee Advance Recovered transaction to

an account. You may override any setting when posting the transaction.

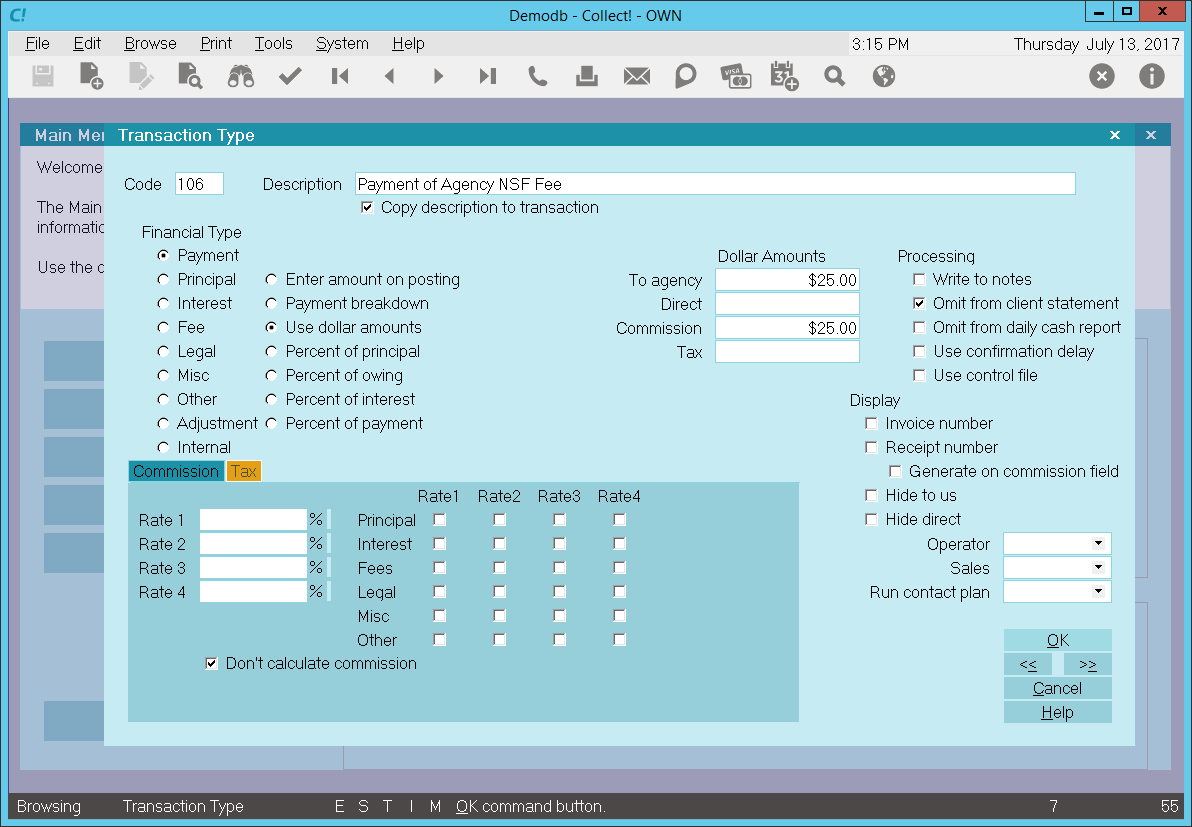

Transaction Type Sample - Payment Of Agency NSF Fee

Let's assume that an operator posts a check payment to a debtor account. A few days later, the check is returned

to you NSF. You process the check, including your NSF fee. Later on, you receive another payment from the

debtor to cover both the NSF check and your NSF fee.

How do you post the payment for the NSF fee?

You may use the Payment of Agency NSF Fee transaction type to post the portion of the check that pays the NSF fee.

The screen shot below shows the settings for the Payment Of Agency NSF Fee Transaction Type.

Payment of Agency NSF Fee - Payment Transaction Type

The rest of this document explains the settings shown above.

By default, Collect! ships with a number of Payment type transaction samples. Collect! uses the 100 series for

payment type transactions, but any Financial Type dotted as "Payment" will be processed as a payment type transaction.

You can have many different payment transaction types for separating the various types of payments you may receive.

This includes any fee payments as well as payments on the account balance. Payment By Check, Monthly Payment,

and Payment of Agency NSF Fee are a few examples of different types of payments.

A check mark in the box labeled Copy Description To Transaction copies the Description

from the Transaction Type form when you create a 106 Payment of Agency NSF Fee transaction on a debtor account.

The Payment radio button is dotted to keep track of payments that are made on an account.

Any transaction flagged as a Payment type, with an amount either in the To Us or Direct field, will affect the balance of the

Owing amount displayed on the Debtor form.

An amount in the transaction's Commission field affects your agency commission amount.

All payment transactions are totaled together and subtracted from the total debt. The result is displayed in the Owing field

of the Debtor form.

The radio button labeled Use dollar amounts is selected and a fixed amount has been entered in

the To Agency field and in the Commission field. Entered as a POSITIVE

amount, this is adds to the total commission amount collected by your agency and decreases the debtor's Owing.

Reporting check box, Omit from client statement. is switched ON with a check mark so that this payment

transaction in not included in the client statement. This transaction is for your own internal accounting and your client will

not be made aware of it.

Reporting check box, Omit from daily cash report is left UNCHECKED so that the amount of this payment is

calculated into the total daily cash received by your agency. This payment is part of the cash flowing into your agency.

Calculations check box, Don't calculate commission is switched ON with a check mark so that commission is not

calculated on this payment. The amount in the Commission field will be used. This will not be overridden by any commission

rate that is set on the account.

Calculations check box, Don't calculate tax is switched ON with a check mark so that tax is not calculated on

this payment.

The way you handle your business will help you decide whether or not to enable any other optional settings.

The way you handle your business will help you decide whether or not to enable any other optional settings.

Display is set to leave both the To Us and the Direct fields visible at all times when viewing the transaction or

Transactions List.

No operator or sales operator ID's have been set to be used as default values when posting this transaction

type. You may want to set the Operator or Sales values to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting this transaction type.

No commission rate has been set to override the commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in for you when you post a 106 Payment Of Agency NSF Fee

transaction to an account. You may override any setting when posting the transaction.

The Payment Of Agency NSF Fee transaction type has been set up to easily post payment of the NSF fee portion when you receive a

"good" payment that covers both a check that previously went NSF and your agency's NSF fee that you charged to the account. In

the sample, when the transaction is posted, the To Us and Commission fields will display $25 as the amount of the NSF Fee

payment. This would decrease the debtor's Owing and increase your agency's commission totals.

For the remaining portion of the payment that covers the NSF check amount, you would use the Payment By Check

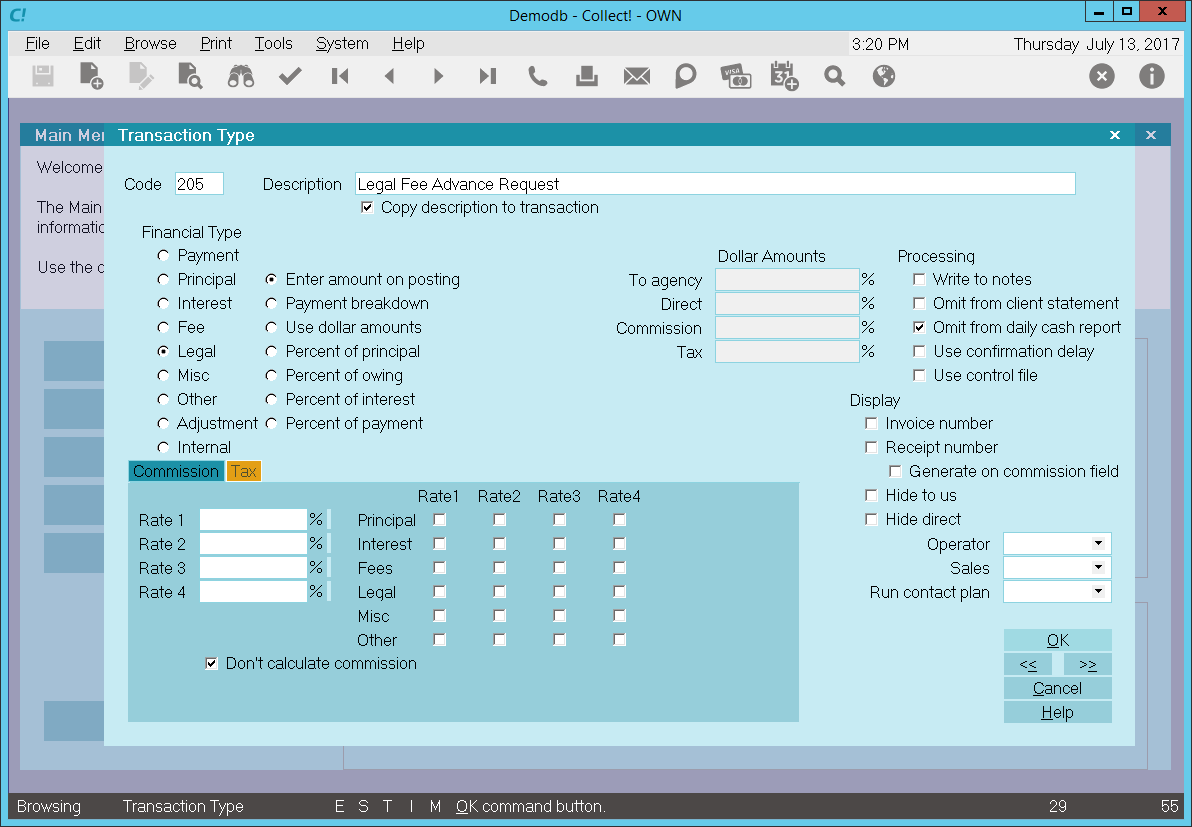

transaction type. Please refer to How To Post a Transaction for more information.